Nick of FM on #40kFarAway [TIF Podcast]

The Extreme Maximizing of JAL Miles

Asia Miles Award Charts & Routing Rules

British Airways Avios: Award Efficiency Rating

TIF Podcast: Traveling Full-Time on Miles/Points w/ Katie & JT Genter

Explaining the 5+ British Airways Avios Award Charts

The 7 Iberia Avios Award Charts

Japan Airlines (JAL) Miles Award Charts & Rules

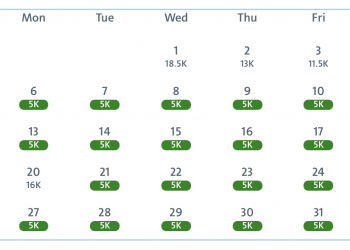

Starting A New Chapter

Best Hotel Rewards Program [InfoGraphic 2019]

How To Get Free Travel With Car/RV Relocation

Best Alila Hotels To Book With Hyatt Points

Map of Choice Hotels [with Choice Points]

Best Use of Virgin Atlantic Miles [by Partner]

50 Cheapest Hotels To Earn Hyatt Points

Cheapest Miles To Hawaii

Why To Consider Chasing Copa Airline’s Status

TBT: The Decline Of FlyerTalk

Devil’s Advocate Unmasked and Podcasted [TIF Ep 7]

All-Inclusive Hotels Using Points

How To Find Cheap Repositioning Cruises

My Friend, Seth, Is A Terrible Travel Companion

TIF Podcast with Greg, The Frequent Miler

Drew’s Guide To Full-Time Travel

The Extreme Maximizing of JAL Miles

Whenever I've done posts comparing the prices across different programs I've already found that JAL Miles are among the lowest, but today I'll show you how to potentially double the value of these already great miles.

As you'll see, I first try to figure out the rules preventing me from abusing maximizing this program with stopovers, stops in my home town, open-jaws, etc... Once I figure out the rules, I have ideas for loop-holes, then I do tests. Then I either find "deals", or I find a new rule.

These fundamentals are things I'm going to apply to other distance based programs as I work my way across every program, which I'm dissecting for my day job.

No one reads this site for the artful writing (-I can barely spell my name-), but I consider this unpublished rule dissection my art.

Hopefully you learn something about JAL miles that can open up an amazing trip, and learn something about program dissection.

Read moreBritish Airways Avios: Award Efficiency Rating

"Drew, what in the world is an award efficiency rating, and how does British Airways Avios have one? Did you just make this up?"

Yes, I did. But get used to it! Because I'm going to be doing posts with efficiency ratings more often!

And not just British Airways Avios, but for many programs. In fact, I got the idea working on an upcoming JAL post.

So this post is really just to introduce the concept of an "award efficiency rating".

Let me explain what it is, and what cool things you can discover from it (using Avios)...

Read moreJapan Airlines (JAL) Miles Award Charts & Rules

Right now I'm digging into JAL Miles and before I do a post on the best uses, I wanted to give an overview of their four award charts.

I have made condensed, easier to read charts and a map for JAL flights, and will generally explain which award chart you use for which redemption.

I also made a chart showing which chart is better under which distance range, the JAL Miles "OneWorld Award Chart" or the "Partner Award Chart".

I'll give a list of partners, and a brief overview of the rules.

Read moreStarting A New Chapter

I've got a big announcement... And I'm going to tell you about it, and I'm going to do it in my typical overly-honest way.

In 2010 I started a wordpress blog. In 2011 Carrie and I took our millions of miles (and little else) and booked a oneway ticket to Asia.

We really had no idea where that journey would take us. If you've followed along, you know that it took us all over the world. That journey - of full-time globetrotting and living in hotels for years - was nothing short of fantastic!

Read moreBest Hotel Rewards Program [InfoGraphic 2019]

Carrie and I both wanted to redo our Hotel Rewards Program infographic and my post on the best rewards program.

The infographic does a good job of giving a visual display for the following areas:

- Number of hotels

- Which brands have the most 4/5 star hotels

- Which loyalty programs earn free nights most quickly

- Status benefits

- Best credit cards

The rest of the post will discuss some of the things not included in the infographic and more details...

Read moreHow To Get Free Travel With Car/RV Relocation

I've recently been intrigued by the idea of car/RV rental relocation as a way to get cheap (or even free) trips.

That's right. You can get a rental of an RV with beds and your gas reimbursed for free (or $1 a day) for simply relocating the vehicle. Your only expense on such a trip would be airfare, food, and possibly paying for an RV campground night.

And while you can't choose just any route, there seems to be popular routes for vacationing and RVing. For example Salt Lake City to Vegas or LA... Which could be an amazing RV trip through Utah, as there are so many interesting, remote areas (like Canyonlands National Park).

In this post I'll list the best websites for finding and booking these rentals and then go over the details of a typical rental.

Read moreMap of Choice Hotels [with Choice Points]

Finally, here is the map of Choice Hotels by points price. This is one of the last hotel chains as part of the Complete Map series (which can also be found on the Resource Page). So be sure to check out Marriott, IHG, Hilton, Hyatt, and Radisson there as well.

Read moreBest Use of Virgin Atlantic Miles [by Partner]

Like Alaska miles, Virgin Atlantic Flying Club has a unique set of mileage redemptions that varies by partner, some of which are amazing deals.

In truth, I made a note to look into their partners after OneMileAtAtime booked and posted about a first class flight on ANA for 120,000 miles... Which ended up being only 92,500 Amex MR points (due to a transfer bonus). An amazing first class deal.

But there are lots of great deals that are even better with a 30% bonus. With a 30% bonus, a oneway to New Zealand for 30,000 miles is nearly 23,000 miles. A 25,000 miles business class ticket to Africa would be 19,200. And a 10,000 mile flight to Europe would be 7,700 miles.

Read moreWhenever I've done posts comparing the prices across different programs I've already found that JAL Miles are among the lowest, but today I'll show you how to potentially double the value of these already great miles.

As you'll see, I first try to figure out the rules preventing me from abusing maximizing this program with stopovers, stops in my home town, open-jaws, etc... Once I figure out the rules, I have ideas for loop-holes, then I do tests. Then I either find "deals", or I find a new rule.

These fundamentals are things I'm going to apply to other distance based programs as I work my way across every program, which I'm dissecting for my day job.

No one reads this site for the artful writing (-I can barely spell my name-), but I consider this unpublished rule dissection my art.

Hopefully you learn something about JAL miles that can open up an amazing trip, and learn something about program dissection.

Read more"Drew, what in the world is an award efficiency rating, and how does British Airways Avios have one? Did you just make this up?"

Yes, I did. But get used to it! Because I'm going to be doing posts with efficiency ratings more often!

And not just British Airways Avios, but for many programs. In fact, I got the idea working on an upcoming JAL post.

So this post is really just to introduce the concept of an "award efficiency rating".

Let me explain what it is, and what cool things you can discover from it (using Avios)...

Read moreRight now I'm digging into JAL Miles and before I do a post on the best uses, I wanted to give an overview of their four award charts.

I have made condensed, easier to read charts and a map for JAL flights, and will generally explain which award chart you use for which redemption.

I also made a chart showing which chart is better under which distance range, the JAL Miles "OneWorld Award Chart" or the "Partner Award Chart".

I'll give a list of partners, and a brief overview of the rules.

Read moreI've got a big announcement... And I'm going to tell you about it, and I'm going to do it in my typical overly-honest way.

In 2010 I started a wordpress blog. In 2011 Carrie and I took our millions of miles (and little else) and booked a oneway ticket to Asia.

We really had no idea where that journey would take us. If you've followed along, you know that it took us all over the world. That journey - of full-time globetrotting and living in hotels for years - was nothing short of fantastic!

Read moreCarrie and I both wanted to redo our Hotel Rewards Program infographic and my post on the best rewards program.

The infographic does a good job of giving a visual display for the following areas:

- Number of hotels

- Which brands have the most 4/5 star hotels

- Which loyalty programs earn free nights most quickly

- Status benefits

- Best credit cards

The rest of the post will discuss some of the things not included in the infographic and more details...

Read moreI've recently been intrigued by the idea of car/RV rental relocation as a way to get cheap (or even free) trips.

That's right. You can get a rental of an RV with beds and your gas reimbursed for free (or $1 a day) for simply relocating the vehicle. Your only expense on such a trip would be airfare, food, and possibly paying for an RV campground night.

And while you can't choose just any route, there seems to be popular routes for vacationing and RVing. For example Salt Lake City to Vegas or LA... Which could be an amazing RV trip through Utah, as there are so many interesting, remote areas (like Canyonlands National Park).

In this post I'll list the best websites for finding and booking these rentals and then go over the details of a typical rental.

Read moreFinally, here is the map of Choice Hotels by points price. This is one of the last hotel chains as part of the Complete Map series (which can also be found on the Resource Page). So be sure to check out Marriott, IHG, Hilton, Hyatt, and Radisson there as well.

Read moreLike Alaska miles, Virgin Atlantic Flying Club has a unique set of mileage redemptions that varies by partner, some of which are amazing deals.

In truth, I made a note to look into their partners after OneMileAtAtime booked and posted about a first class flight on ANA for 120,000 miles... Which ended up being only 92,500 Amex MR points (due to a transfer bonus). An amazing first class deal.

But there are lots of great deals that are even better with a 30% bonus. With a 30% bonus, a oneway to New Zealand for 30,000 miles is nearly 23,000 miles. A 25,000 miles business class ticket to Africa would be 19,200. And a 10,000 mile flight to Europe would be 7,700 miles.

Read more

![Nick of FM on #40kFarAway [TIF Podcast]](https://travelisfree.com/wp-content/uploads/2019/10/travel-is-free-podcast-nick-40K-350x250.jpg)

![Hitch-Hiking, Booking w/ ANA Miles, Cheap 5* Hotels [TIF Podcast]](https://travelisfree.com/wp-content/uploads/2019/08/travel-is-free-podcast-carrie-and-drew-350x250.jpg)

![Best Hotel Rewards Program [InfoGraphic 2019]](https://travelisfree.com/wp-content/uploads/2019/07/Screen-Shot-2019-07-29-at-3.30.43-PM-350x250.png)

![Map of Choice Hotels [with Choice Points]](https://travelisfree.com/wp-content/uploads/2019/06/complete-map-of-choice-hotels-350x250.png)

![Best Use of Virgin Atlantic Miles [by Partner]](https://travelisfree.com/wp-content/uploads/2019/06/virgin2-350x247.jpg)

![Devil’s Advocate Unmasked and Podcasted [TIF Ep 7]](https://travelisfree.com/wp-content/uploads/2019/06/travel-is-free-podcast-devils-advocate-350x250.jpg)

![Most Valuable Hyatt Hotel Redemptions [A Data-Driven Look]](https://travelisfree.com/wp-content/uploads/2019/06/data-driven-look-hyatt-350x250.jpg)

![Why Amex MR Is Best & LifeMiles Loopholes [Ep 6 of TIF Podcast]](https://travelisfree.com/wp-content/uploads/2019/05/travel-is-free-podcast-nick-reyes-350x250.jpg)

![Best Hotel Rewards Program [InfoGraphic 2019]](https://travelisfree.com/wp-content/uploads/2019/07/Screen-Shot-2019-07-29-at-3.30.43-PM-601x375.png)

![Map of Choice Hotels [with Choice Points]](https://travelisfree.com/wp-content/uploads/2019/06/complete-map-of-choice-hotels.png)

![Best Use of Virgin Atlantic Miles [by Partner]](https://travelisfree.com/wp-content/uploads/2019/06/virgin2.jpg)

![Best Hotel Rewards Program [InfoGraphic 2019]](https://travelisfree.com/wp-content/uploads/2019/07/Screen-Shot-2019-07-29-at-3.30.43-PM-360x180.png)

![Map of Choice Hotels [with Choice Points]](https://travelisfree.com/wp-content/uploads/2019/06/complete-map-of-choice-hotels-360x180.png)

![Best Use of Virgin Atlantic Miles [by Partner]](https://travelisfree.com/wp-content/uploads/2019/06/virgin2-360x180.jpg)