Chase cards are incredibly generous and the Chase Sapphire Preferred has become nearly every traveler’s favorite credit card. There are a number of transfer options, and many posts on things like Hyatt Rewards often come with a recommendation of transferring from Chase UR points. But my recommendation nearly all the time is to transfer to United.

United has gotten a bad rep after the devaluation causing business class and first class prices to go up, sometimes by a lot. Yet, I think you can waste a lot of points transfers to anything except United, most of the time.

Let me explain a few things.

- Yes, there are other great uses

- United miles still have tons of value. I’ll explain why.

- United miles are better than other miles programs in many ways. I’ll explain why.

- And why the other options are actually terrible.

Earning United Miles with Chase

I should also mention that there are multiple Chase cards that earn United miles. (And here’s a master chart of what credit cards can earn miles).

There are two main United cards:

- United Explorer (personal)

- United Explorer (business)

Then there are a few cards that transfer from Chase UR points to United miles:

- Chase Sapphire Preferred

- Ink Plus (business card)

- Ink Bold (can’t apply for this card anymore)

Then there are cards that earn Chase UR points but don’t transfer to United directly, but you can combine points balances with the cards above, then transfer to United miles:

- Chase Freedom

- Chase Sapphire (the no annual fee version of the Chase Sapphire “Preferred”)

- Ink Cash (business card, no annual fee version of Ink Plus)

Yes, there are other great uses

There are exceptions to nearly anything. United isn’t always the best price on a given route.

For example, British Airways Avios for a Miami to Jamaica flight are 4,500 Avios for a oneway when United would be 17,500 United miles. Or Singapore miles are the best way to fly Singapore Suites.

Check out my post 40 Best Uses of Chase Ultimate Rewards Points. I consider these to be 40 great redemptions with all of the Chase partners.

Still, these are exceptions. As I’ll discuss Avios routes without fuel surcharges and with great prices are the exception, not the rule. I know I can always get great use out of United miles. With other programs, the 40 things listed are above average value.

For many of the programs, finding great prices, avoiding fuel surcharges, and even booking, can be ordeals. With United, it’s straight forward and, I’ll argue, still will be a better value.

Another exception would be someone who has 1 billion airline miles and zero hotel points. Those people exist but are definitely not the norm. Most people get way more value out of miles than hotel points.

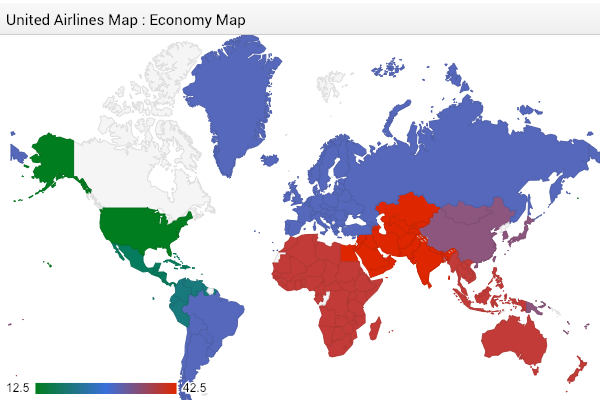

Economy Prices Are Still Great

During the devaluation economy awards were barely touched, and when they were it wasn’t a big deal. In many areas United miles are actually the best prices, and some are exceptionally great. In my recent post on getting to Latin America with two tickets, United still stands out as an amazing value. 10,000 miles for Mexico to Peru. 35,000 miles to Fiji or Japan. So many great values.

Fuel surcharges being avoided is amazing for all classes

This applies to all classes of booking, but now that I think about it, it could possibly be even better for business and first class. Especially considering fuel surcharges as it can be $600 on a simple roundtrip to Europe! $600 more, and that’s just for economy!

What’s crazier is that there are a number of examples where fuel surcharges using miles go up for business and first. I’ve seen fuel surcharges over $1,000. That’s crazy.

So let’s just say that you find a ticket that is actually cheaper with a different transfer partner. The next question is whether or not it has fuel surcharges being passed on? Is saving a few thousand miles really worth paying $1,000?

Paying fuel surcharges ever is crazy. They are always optional given that you could just use United miles. Of course, a lot of people don’t understand this stuff, but that’s why I’m here and have the Master Chart of Avoiding Fuel Surcharges.

Business and First Prices aren’t that bad

First thing you need to understand is that AA and Alaska are not transfer partners of Chase. So yes, United is higher than the best two programs out there, but that isn’t relevant here. If you have Chase points, who’s the best for Business and First Class tickets?

Another thing to understand is that United has two award charts for using United miles. One for using United miles on United flights, and another for redemptions on Star Alliance partner flights. The partner flights are often a bit more expensive. Neither award chart is as good as AA’s award chart, but it’s still good.

Going to Europe, United airlines might be the best business class option for availability and price.

Even using partners to Europe, who else are you going to use?

Korean? Well, I’ll give you that Korean is actually cheaper by a bit, although it’s a different alliance all together. But there are a number of reasons Korean is a terrible idea.

- There are horror stories of booking. You have to call the Korean office to book partners… which is bad on its own. Lots of people have said they had trouble booking the tickets at all.

- But you can only book for family members and it requires filling out a form and faxing proof of relationship!

- SkyTeam is tough for most americans because Delta releases so little saver space. For example, when looking for tickets to Tahiti, I could find Air France flights from LAX to Tahiti but I couldn’t get Delta tickets to LAX.

- They still pass on fuel surcharges.

- Delta and KLM don’t even have first class.

And not all of their prices are cheaper. Is it really worth the hassle? For Europe, it could save a ton of miles on a First Class ticket (if you can find a seat or an airline that actually has first class). So yes, I would say that is a possibility. You’ll still end up paying more.

But to most of the rest of the world, the fuel surcharges would go up and the savings go down.

Singapore? I agree there are a number of redemptions with Singapore Miles that are great. Domestic flights, flights to Hawaii, and for flying in Singapore Suites.

See Best Use of Singapore Miles.

But seriously, those are of the few exceptions. In general you’re not going to save any miles, and you’ll gain fuel surcharges.

British Airways? I can’t entertain the idea that Avios will save points on a long haul for very long. It’s often such a terrible idea often costing significantly more than United miles. And the best availability to all of Europe, Africa, Middle East, and Asia is British Airways which has $600 fuel surcharges in economy and more for Business and First.

The best uses are generally with short direct economy flights. In terms of business and first, no one thinks of British Airways first.

More reading on Best Avios uses:

Prices aren’t getting lower

All that to say, people generally complain that United isn’t a great Business/First class option anymore… but what are your other options? The other Chase options aren’t exactly great for first class.

AA and Alaska have better prices, but who cares? And I hate to address the elephant in the room, but those airlines haven’t devalued their miles in a long time. They are exceptions because of that. And when they do, what do you think their first class prices will look like? And ultimately it doesn’t matter what AA’s redemptions are when we’re talking about Chase transfer options.

Stopovers (and getting even better prices with them)

One advantage of United is stopovers. It’s hard to sell this as a major point when most people don’t understand the full potential of it. But I’ve written plenty about United Stopover Secrets.

Even the basic point that United allows 1 stopover and 2 open-jaws on a roundtrip is ahead of the curve. Plus, they are bookable online, which makes my life easier (I hate calling). Check out United Miles Routing Rules.

This increases the value of miles and could potentially allow you to book First Class tickets that otherwise you wouldn’t be able to piece together, or wouldn’t be allowed to route with another airline. Also, it allows you to see more places and book less tickets to do so.

Then there’s the old trick where you book a stopover in a place that has the lower price. You don’t need to compare tickets to Africa with another airlines prices, you can make it price out as a Japan ticket. 😉 Click here to read United’s stopover secrets.

Better than ALL the other options

We’ve only been comparing Chase transfer options for flights. But the value of hotels is incredibly low.

Take a Hyatt stay. 14,000 Chase/Hyatt points would get you a category 4 Hyatt, like the Grand Hyatt Kuala Lumpur. I would put that hotel on the higher end of cat 4 values. Yet the hotel often goes for $150. But 14,000 Chase points via their booking portal is actually worth nearly $170 in the booking portal.

This means that you would actually save points by not transferring to Hyatt. Plus you would earn elite night credit and points.

Marriott and IHG are worse. A top tier IHG hotel is 50,000 points, like the InterContinental Hong Kong. But the IC Hong Kong often is only $250 a night and 50k points is worth $600 of hotel bookings on Chase! You would almost always be losing points by booking your stay this way!

Top Marriott Points redemptions can run you 70,000 points ($840 of Chase bookings), which would be a terrible use of Chase points. But this is often true for even low redemptions, like I saw some cheap hotels coming up in my path available for 15,000 points. That’s $180 in Chase hotel bookings. So I would be losing points on nearly every end.

“Drew, but what about the Park Hyatt Sydney or the Park Hyatt Maldives”

Yes, out of the thousands of hotels possibly booked, there are a few hotels that are better booked with points, and the Maldives is no doubt one of them. These are very rare exceptions.

But in cases like the Park Hyatt Tokyo which are probably close to equal… you don’t have to book a Hyatt, you could book the InterContinental. You could use other points.

Either way, there are few examples where the value of a hotel redemption is obvious, and nearly all flights are obvious redemptions. Even 80,000 points to Bali is way cheaper than the often $1,500+ ticket. And that’s before the stopover or price tricking. And that’s an example that many would say isn’t a strength of United miles.

Conclusion

If I have to transfer my points before canceling a card or something, I would advise nearly anyone to go with United. Unless you have a very specific redemption in mind, United miles are way better.

Often newbies read my posts and get worried about getting the best value out of every mile. Believe me when I say that you’re likely not doing it wrong. If you’ve transferred from Chase UR points to United miles, you’re doing better than booking a flight through the portal.

If you’re using United miles at all you’re probably getting a decent value and there are few Chase alternatives to save miles, and it likely wounldn’t be much. Those savings are rare. So you can rest in confidence.

If you’re interested how to book a stopover with United miles, it’s actually pretty easy to do online. Just go to “multiple destinations.”

But don’t obsess over that either; you’ll earn more miles in the future, don’t worry. The important thing is to see the places you want to see.

Back to my point. It is rarer and rarer that I transfer to anything but United. Yes, there are other good options, but even among those options – like a few British Airways Avios routes – those other options have other ways of earning points. There are other cards that earn Singapore miles, and other cards that earn British Airways Avios. But Chase is the only way to earn United miles. And if you don’t see the value, then you might not know all the stopover tricks.

![The [Only] United MileagePlus Award Chart](https://travelisfree.com/wp-content/uploads/2019/04/United-MileagePlus-United-Airlines-Award-Chart-120x86.jpg)

I get what you’re trying to say but I think if you follow your argument to it’s logical conclusion, we should stop collecting UR points for now because their best use is as UA MP miles, which aren’t the best miles out there. Heck, they’re not even the best miles to fly United, that would be Aeroplan (MR) in Y or M&M/Krisflyer in J.

Aeroplan because they don’t charge a close-in booking fee or YQ on United so are cheaper domestically and only 90k miles to Western Europe, M&M because they charge 17.5k for transcon J and Singapore if you want to fly UA to Hawaii in Y or J.

I’m not sure why that’s a conclusion based on anything I’ve said.

1) I never said “only collect the best miles out there, and stop collecting other things”. I scoop up Lufthansa Miles, United Miles, Avios, Singapore Miles… whatever.

2) If you read the article, my major points are that United’s prices are competitive AND it’s not just the price, but the benefits. No fuel surcharges, and stopovers are incredible. I’ve also shown in many post how to get some interesting routes and prices to work on United.

What about Southwest? A lot of value there. I fly almost only domestic, Mexico and Caribbean so these seem to make the most sense to me along with BA Avios. I can’t argue with United being the best for international flights.

Well, I’ve gotta agree that Southwest is great for domestic. Even my favorite to the Caribbean. And I already mentioned Avios as a great option.

In a world of travel possibilities United is the better option at 99% of the airports than Southwest or Avios. So Southwest being better is an exception. So that’s why I kinda consider it an exception.

Also, I should say that I have never ever transferred from Chase to Southwest in 4 years of having the Southwest companion pass. I’ve always had enough from the Chase cards.

So it is great for domestic, but I have enough southwest points. The expensive thing is the rest of the world.

I gotta disagree on this one. The absolute best use of UR rewards is on Southwest when combined with a companion pass.

For international flights.. I would agree that United is probably the best value for UR reward point transfers.

I totally agree on the value of the Southwest companion pass.

Although I don’t see the value being from Chase. 90%+ of the airports in the world aren’t serviced by southwest and are star alliance destinations. So I need United points more.

In 4 years of having a southwest companion pass I have never needed to transfer from Chase to Southwest. It could happen, but it will be an exception, not a rule. I just haven’t run out of Southwest points as quickly. The need is less and the cost is lower, therefore I go through United miles faster. Thus, 110k from the southwest cards is more than enough, and the Chase UR points should go to United.

That’s how I’ve always done it, and I probably fly a dozen southwest flights a year.

I have 130k UA miles that I’ve not been able to find a good use for in last 1 year. In the meantime I have redeemed close to 800k AS, AA and BA miles combined.

your analysis is good for the average person but I don’t agree that one should look at a program for the most broad redemptions. I use programs for their strengths rather than their weaknesses.

I live in sf bay area and alaska has a lot of direct flights. I just booked sjc-lih RT for 25k avios. I collect ur for such flights rather than for ua.

I also think that southwest is still a good redemption because of all teh flexibility you get when using points. Points go back to account on cancellation while if you had a paid fare, it can only be used for one year after booking.

I’m not saying UA is a worthless program but it’s only one of the good partners for UR.. definitely not the best one for me given my location.

Since UA is mostly good for economy, I do better by using flexperks or travel cash back cards for those flights. Plus I don’t have to deal with the hassle of finding award space.

If you’re looking at one specific flight (sjc-lih), then sure, there are exceptions where something else is a better use. My opening was about how there are exceptions, including Avios flights, like the one you mentioned.

Also, I am talking about United’s strengths. No fuel surcharges, stopovers, 70k for a stopover in South Africa on the way to Japan, 10k for Mexico to Peru, etc… these are United strengths not averages. It just also has good averages.

If you’re looking for possible good uses of United miles, you need to read this post. http://travelisfree.com/2014/04/08/uniteds-stopover-and-routing-rules/

If you think flexperks can do those things better in economy, then seriously, you probably haven’t read that post. United is full of amazing strengths. I can’t imagine finding any of the global routes listed with or without stopovers anywhere close to 70,000 flexperk points. My guess is that those 70k routes would be 200k+ for the cheapest examples.

Drew, I have used your free one way and stop over tricks. I did SFO-LHR-SFO//JFK once. Other time it was SFO-ANC//ANC-DEN-EWR-DEL and back to SFO. But I find myself doing more of the plain RT redemptions because

1. most of the time I book 11 mo in advance so I don’t have the free one way flight to work with on the other side

2. sometimes the free one way flight is not available

3. sometimes I book one way

4. i don’t have schedule flexibility and extra vacation time to use all the stopovers.

I know the programs you use are location specific. I plan on doing these trips with avios in near future. They are the norm for me rather than the exception

SJC-OGG

SJC-SJD

SFO-PVR

SJC-SEA

I also routinely redeem UR for southwest flights.

I mean, I agree, and I listed Avios as a great exception to United being the best.

It’s a general best. :-p

When transferring my father-in-laws points before closing, I chose United. If he live on the west coast and wanted to go to Hawaii, or lived in maimi and wanted to go to Jamaica I’d transfer to Avios. There’s probably 100 other examples.

that’s how i feel too. What works for Drew doesn’t always work for us but it’s good to be aware of what’s possible.

SFO has decent *A coverage though not as good as ORD. if UA had nor non alliance partners with good availability like emirates it would be a different story.

Drew, first of all, love your site.

I have to agree with some of the other folks who have commented though. I have used my UR points for United, Southwest, and BA, but if I could only have one transfer partner available it would definitely be Southwest, and I don’t even have the companion pass.

You are leading an unusual lifestyle traveling the world, going wherever there is a combination of an interesting destination and cheap miles option. For most of us (who live in America), the vast majority of our travel is domestic, and we’re probably less flexible than you in terms of what destinations we want to go to and what dates we can go.

I live in Chicago and so probably have the best access to United flights of any city in the world, but yet domestically I find that Southwest is better than United 90% of the time. United has poor inventory availability, especially on the times I want to fly (like a Friday out and a Sunday back in) unless I want a 6 am flight or want to make connections. With Southwest, I know I can always extract good value from the points for the flights I want. Then you add on the free cancellation with Southwest, and it’s a no brainer for me.

Yes, United is the best UR option internationally, no doubt. But Southwest rules domestically, and domestic is most important for many people.

How are you getting so many Southwest points that you never have to transfer UR points to them may I ask? Is it just you and Carrie getting the signup bonuses for all 4 (it’s 4 right?) cards plus limiting points use through the companion pass?

that’s how i feel too. What works for Drew doesn’t always work for us but it’s good to be aware of what’s possible.

SFO has decent *A coverage though not as good as ORD. if UA had nor non alliance partners with good availability like emirates it would be a different story.

So I want to be clear that I don’t write my blog targeting full time travelers who live on hotel points. 😀

The post was actually inspired by transferring my father-in-laws points before closing an account. He had no plans but we still chose United.

I too travel a TON domestically. We take a dozen Southwest flights a year. So I agree on the SW value. However, I have never transferred from Chase to Southwest. Instead I have plenty of points for Southwest via the cards gotten to get the companion pass.

So even if my target audience travels domestically, it’s not like I don’t.

We get the 110k southwest points every other year and it lasts us. I suppose if there were more of us we’d need more. so that would be an exception.

But 110k last easily a dozen flights. We book deals and watch to see if the price lowers and all that stuff.

For all the commenters interested in WN transfers, the issue is that you get better value using a 2% cash back card for all of your spend than using any chase card to generate points either native or transferred due to the way WN value their points.

I would argue if 90% of your focus is on domestic travel with WN and you are using a Chase card that transfers points instead of the WN cards for the companion pass and a 2% cash back card for all other spend you are leaving money on the table.

It depends on your source for the UR points. Most of them for me are coming from Ink and Freedom bonused spend. The free cancellation and funds un-linked to passenger names are worth it.

Yup, my UR points are mostly from signup bonuses, with some add’l from 5x spending I’ve done on the Ink Plus and 2x spending I’ve done on the Sapphire Preferred. I try to avoid 1X spending on it for exactly the reasons Vinhsynd points out.

Great point.

Your really right when you say ” Korean is a terrible idea.There are horror stories of booking. You have to call the Korean office to book partners… which is bad on its own. Lots of people have said they had trouble booking the tickets at all.” We tried to do this very hard back in February. We called and wanted a RT from SEA to CDG and they right away got us two economy seats on non-stop flight with Air France going there but could get nothing at all coming back from anywhere in Europe even to anywhere in the USA for a 14 day period of flexibility and this was with 9 phone calls to Korean over 9 days of trying! It was beyond frustrating. we ended up using more miles and transferring UR points to United but did get a open jaw with one free stop over with United.

I’m sorry about the terrible experience. This and similar stories kinda makes me lean towards not writing about korean as much. I don’t want to recommend it to people when it’s such a headache.

Glad you still got the trip.

I’m happy you make posts detailing these ways you can go to exotic locations and get great value. Anyone can book a domestic RT using practically anyone’s miles…it’s not brain surgery. Your posts that show the crazy uses of UA miles that I had no idea of (I’ve personally used US-Africa-SEA for 65k and Japan-Oceania for 25k) have gotten me tickets worth respectively about $10k and 4.5k). That’s crazy! This is a site that not only lets you learn how to get good value, but to dream. Thank you!

“This is a site that not only lets you learn how to get good value, but to dream.” Amen. For all who think/know they get better value with other options, they really probably do…this kind of post may be directed more for those who don’t already know, and would otherwise be choosing randomly (or poorly). Drew gives the tools and how to use them, we all get to decide what to create that best fits our situations/goals to maximize value. Great post as usual!

Thats true! lol

If you’ve run the math and said, “I know I get better value with ___” then you’re already on your feet. But a lot of people have to transfer and cancel and would otherwise put into something like a hotel where they actually would have been better off with cash.

Thanks for the kind words Dizzy! To my that’s a high compliment!

I’m a dreamer not a mathematician. 😀

I think the question of which type of mileage currency is best will be a personal matter based on patterns of use, which depend on a multitude of factors. When I look at my award redemption patterns for the last three years, I see I am always churning quickly through my United and Alaska miles; regularly using American and Southwest miles and Avios, but not as often; and sitting completely idle with my stash of Delta miles.

With UR points, United is the standard for me, and I love the posts showing how to maximize them, since I’m always looking for more.

That’s true and I try to start off hedging my bets so to speak.

But Carrie makes fun of me because at EVERY conference people come up and ask what they should book and I always say “it depends”. Her point is that people just want to talk and I end up awkwardly saying nothing! :S

But it does depend and I struggle with he one size fits all, more so in real life. :-p Where do you want to go? Where do you live? Do you already have miles? etc…

On a blog it comes across different because I am saying United IS the best… which they are of the UR transfers. But that doesn’t mean it’s the best in all situations or for all people. I just know almost all people will get good value there.

For those who keep mentioning Southwest, when I’ve checked recently Southwest miles have priced out at around 1.6 or 1.7 cents a piece. Having the companion pass doesn’t double the value of the miles, because your companion can fly with you free on a revenue ticket as well. It’s probably not a bad use, and often the cheapest miles for domestic flights esp with the free checked bags. But if your miles are limited and you want to travel internationally, you might do better paying for the Southwest flight and using UR points on United. Plus, the Southwest points are so easy to earn by signing up for both credit cards, how many do you need?

Right, two really good points.

It’s a fixed minimal value, so it’s hard to argue that the value is more.

But also yeah, I assume everyone reading this blog will want to travel internationally at some point. I do. And if you don’t, the Southwest posts are there and a better resource. Don’t even bother with UR if that’s the case. IMO.

The examples of transferring points to hotels vs. booking hotels through the UR portal is timely for me; thanks!

Thanks for the comment Elaine! Always nice to see ya around here.

Yeah, me too actually. I have been looking at it a lot in order to make budget goals. With Citi, Chase, etc… And in the end, especially transferring to IHG and Marriott, I almost always would save points going through the portal… which doesn’t say a lot about the value of the redemption since it’s fixed at 1.2 cents.

Cheers

Drew, I mostly agree with what you stated, but I think you are missing the most important benefit of UR. Which is to be able to “top up” your or your wife’s account in case you need it and do not want to spend cash buying points. I have had to do that several times with Hyatt, Southwest and United. In the old days I could top up my mom’s and my kids account and used miles that otherwise would have gotten expired. Sadly, you’re only supposed top up your significant other’s account now but it still is a very usfeul (IMHO most important) benefit.

The other thing that you forgot to mention with respect to United miles is that United will protect you in case of a schedule change. For instance, in the case of a missed or cancelled flight they are VERY flexible. I really do not want to provide too much details and kill deals but I was very impressed what is possible…..

Some other airlines just refunds your miles….

:-p

No you’re right. And I’ll confess to transferring to Hyatt in Jan to top up. (Don’t tell anyone)

But I have more Chase points than I have accounts to top up. So it’s a good thing but it isn’t the majority of my use.

I will continue transferring 25k points per year to amtrak (to choice), which should be noted, also some decent amtrak redemptions as well (san-LA, nyc-bos or was, etc). I hate to transfer to SW and rarely need to, but the free cancellations is a huge benefit. For complex RTW tickets (and lots of other niche uses), united is still amazing.

Totally forgot about Amtrak. Although the card is practically dead, so…

Drew, first off I looooove the website. We have almost zero flexibility to travel internationally, but if we did, we’d be using everything you mention! I read your blog mainly for entertainment and to daydream a little bit. My fiance and I really focus on weekend trips. Every month we are going somewhere, but since it’s always for the weekend, it’s always domestic. We get fantastic value from Southwest, we’re about 15 minutes from New Orleans airport. We’ve booked 5 flights this year, including Costa Rica (Thanksgiving) and Christmas trip home. Not great for points value, but 2 of the trips were “have-to’s”. People have already mentioned the top-up option for UR points and the 5x bonus spend for Ink, so I won’t belabor those points.

I’ll end with this thought: I read other blogs for signup links and current deals. I read yours for crazy ideas and general way of thinking, and crazy ideas that I may or may not use, but are awesome to think about.

I really appreciate the comment, but also am flattered. I’ve long thought that the highest praise would be if someone where to read the blog and not collect miles. I guess next step would be someone who doesn’t fly internationally. 😀

Your article reminds me of someone bragging about the buffet at Denny’s……..UA FC international is a HORRIBLE product…………Singapore and Hyatt for luxury…….it’s not even debatable………….

You probably missed some key points. I’ll back up. You can actually use United miles on different airline partners. United is part of the “Star Alliance” which has many partners including Thai Airways, Air New Zealand, Lufthansa, etc… You don’t actually have to fly on United.

In most situations it’s better to use United miles to avoid fuel surcharges, rather than Singapore miles which do pass on fuel surcharges. There is an exception, which is that Singapore has better availability to the suites… which I specifically said in the post.

I did barely mention United first, but only in comparison to Delta and KLM which don’t even have first.

The point of the article is not that you should fly United, it’s that you should collect United miles.

Normal newbie misunderstanding, no worries.

There’s no newbie misunderstanding here as I just think your logic is totally wrong!

Which part did you not like?

But I think you’d benefit from knowing that you can use United miles on partners. A lot of people don’t get that concept. Like you, people think United miles means you have to fly on United (which you state is a horrible product). But you can use United miles for lots of airlines actually.

Here’s a post on alliances that will explain it better. – http://travelisfree.com/2014/06/16/airline-alliances/

If you understand this concept you won’t have to fly that “horrible product” or be confused about whether or not I was suggesting it… because I wasn’t.

Have to agree.

I just booked my mother in biz class on a RT from Michigan to Rio with a saver award, 110K miles transferred from UR. She’ll get to fly on a Dreamliner before I do.

AA flies a 777-200 with their old angle-flat business product, and they wanted 260K miles for the trip in biz. She could have bought economy tix and tried to upgrade with 50K AA miles, but biz was 1/2 full already and we were looking at less than a 50-50 chance of getting the upgrade. No thanks.

This is he dumbest post ever, UA miles are terrible

Why do you feel they are terrible? Have you read my posts on United miles?

Thanks for another great post. I’ve booked United Asia flights for 70,000 points that I think would run in the $2,100 range. That’s a great value. In fact, I’m already committed to United for my next Asia trip, but I am in a bit of a pickle. Wife and I are going into churn 3. Each of us got CSP in churn 1. Churn 2 was when Chase got fussy. My ink was rejected and I barely got my United Explorer. Wife got her United Explorer. We burned our CSP UR on an earlier trip. Basically, we are going to use our left over UR, plus the United Explorer bonus to cover our 70,000. Problem is we have a > 2 y/o (and no points for him) and I’m reluctant to go back to Chase for churn 3. I can’t MS that much in the time I need to book (maybe 2 or 3 months). I was thinking of using TY or MR on Singapore, but if I recall correctly, it’s like 90,000 or some crazy amount of points. That would get the job done, however, and right now it seems safer to avoid chase. Any thoughts?

Also, I will tip my hat to (or click the affiliate link of) the person who can answer why I can’t book the two trips below on United’s site. There are no layovers below, only stopovers or open jaws.

Trip A: DC-Shanghai/Qingdao-Seoul/Tokyo-DC

Trip B: DC-Shanghai-Qingdao/Seoul-Okinawa/Tokyo-DC (I think this is technically 3 open jaws…my original newb thought was that I was just using the stopover and two open jaws separately)

Thank you!

Great post Drew, and I’m not a newbie in case some readers assume that. I appreciate difference in opinion as long as there is mature civil discussions as most comments show. However, a couple that blatantly stat that this is dumb or your wrong with no backup is pure childish.

We travel primarily for leisure and primarily internationally at least three times a year. IF you have UR points/collect UR points, then United is one of the best for international redemption over the other options in that alliance. This is what I read as the jist of the article, and wholly agree with it. I’ve used United to fly on their alliance members (like Asiana), and on United. I’ve done Lufthansa too. Now half my flights are through Aa miles but UR miles are the easiest to compile for me.

Also liked your write up on United stopover secrets 😉 awesome when used.

where do you land on using 200,000 united miles for a round the world ticket? it seems to only cover 6 stopovers in all three zones.

Trying to learn a bit about double dipping. If I book my tickets using CUR can I still earn miles or is the better option to transfer my points to UA directly?

THX!