The Southwest Cards are back to 50,000 points for the sign up bonuses, and this is super relevant as the year comes to a close for one incredible reason… the potential to have the Companion Pass for almost exactly two years.

If you’re not familiar, you must read: Maximizing Southwest Companion Pass. But basically you can earn the companion pass via points from the credit card, but it lasts for the rest of the calendar year you earn it in and the rest of the next calendar year. What I’m about to show you is how to get the cards now, have the points post in January and then have the companion pass (and 110,000 points) for all of 2015 and all of 2016. This is the real deal folks.

Once you earn 110,000 Southwest points in a calendar year, you get to designate a person to fly with you for free (+ the ~$5 taxes domestically). It doesn’t matter if it’s points or cash, the second person is free. And the best part is that it lasts the rest of the calendar year and through the next one.

Which is great timing because the 50,000 point Southwest cards are back! So let me give a tip for playing it this year.

Get the cards nowish, get approved and get the cards in December sometime. But the key is to not have the points post until January. The safest way of assuring this is not to do any spending on your Southwest cards until Jan 1. Then after Jan 1 put $5k on each card… which will earn you 110,000 southwest points and the companion pass. Which is basically 220,000 points for us, which is incredible considering I’ve booked two flights recently for under 4,000 points and a couple more for under 7,000.

But if you want to go pro and do your spending in December but have your points post in January so you get the companion pass as soon as possible you’ll need to understand one key element, when your points post.

Warning: Understand if your goal is to spend the $3,000 required in December and you misunderstand and your points post to December… you’re basically screwed. To get the companion pass all 110,000 points have to post in the same calendar year. If you have 55,000 points post in December and then 55,000 points in January, you will not get the companion pass. Period.

So the safest way of understanding when your points post is to spend a dollar on the card to see when the points post. Southwest will tell you the exact date that they post.

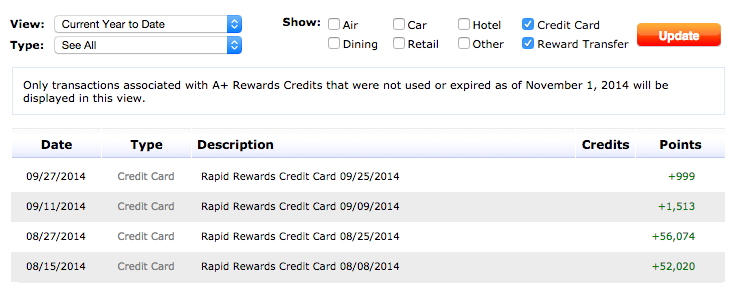

But there’s a more pro way of doing this. It’s actually super simple, it’s just clicking “see statements” on Chase’s end. I’ll show you what it looks like for Carrie.

Looks like this:

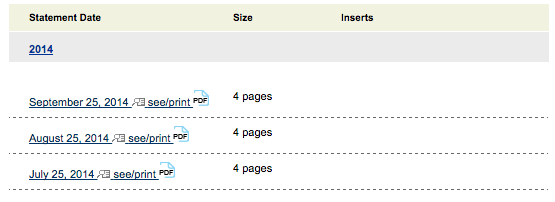

Here’s the personal card statements:

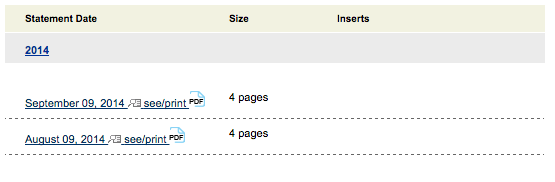

And here’s the business card statements:

Notice that the personal card statements are always posted on the 25th of the month? Can you guess which day of the month?

Yep, points from the personal card posted on their statement date or after. In the picture above, you can see that the details show the points are from the 25th, the 25th, and the 8th/9th.

All this to say, that if your next statement will close on Jan 1 or after, the points aren’t going to post before that date, but likely days after.

Check your statement, and see when the points would likely initiate posting. If the points won’t post until the new year, you can be sure that you can spend in December and they won’t post.

What’s the point of all this?

Two things.

First, I’m telling you how to get the companion pass for the most amount of time. This is personally how I would have played it if I weren’t out of the country for the first half of 2014. Either way, with average spend of 5,000 points we’re already down to 50,000 points. So no worry about getting my use.

But more relevant, I feel, for a lot of people is that they are wanting the cards now while the bonus is here, or because it fits in their app schedule. Because a lot of people want to apply now, but want the companion pass for all of 2015 and 2016. BUT, if they apply now, they only have 3 months to spend the required $2,000 for two cards. If that’s the case, they probably can’t afford to do all $4,000 in January.

The remaining $6,000 can technically be done anytime within the calendar year, but that should be pretty easy to knock out anytime.

Plus, it’s a concept that can help you figure out your annual fee, and has cross over to other programs and credit cards.

Now if you’re paranoid about doing the spending in December, I suppose you could just do $1,500 on each of the cards in December and the remaining $500s in January (along with the remaining $6k).

Conclusion

Now, I realize I don’t have affiliate links for the Southwest 50k Business card anyways, so what you should do is pick bloggers that you would like to support and sign up for the cards via their links. I personally just signed up for some cards via Frequent Miler’s links last week, and on this page here, you’ll find his links for the Southwest cards.

But really, this truly is one of the best values in the frequent flyer world, why not have it available to you for two years?

More-or-less my plan, but since Chase doesn’t seem to like giving me business cards I’m gearing up to just go with the personal card and then supplement the other 60k points reselling the first time that the SW portal offers a 19x opportunity with Sears. Hopefully knock the spend requirement out at the same time. They seem to have been bumping up the portal bonus a lot recently, but if they don’t within the first month or two of the new year, I’ll re-strategize ;-p.

Whatcha do to get on their bad side?

Did you see this? http://frequentmiler.boardingarea.com/2014/11/13/50x-southwest-points-per-dollar/

I must not be charming enough when it comes to schmoozing the business reconsideration line operators. I’m batting 0% on that side of Chase. Even following the guidelines you’ve posted in the past for getting business cards accepted. I’m apparently cursed.

I saw that post the other day – great for covering small gaps in points before the end of the year (or even trying to have points hit after the first), but I don’t know what I’d possibly ever do with the $1,100 worth of flowers or chocolates needed to cover the ~55,000 SW miles needed on top of one card’s bonus. Plus I’m positive I can greatly lower my net cost (actually strategizing to turn a slight profit) by reselling for the difference.

I had passed the flowers deal on to a friend who I thought had been accumulating a good deal of SW miles this year, but it turns out she was still too far off to make it practical. Instead, she’s been stockpiling Marriott points and is planning to use one of their hotel + air packages to get the CP in January.

FOLLOW UP:

I decided to pull the trigger to apply for the personal card today to have it ready to start putting a little bit of spend on in December. Followed your recommendation and applied through FM’s link. Got approved no problem.

For shits and giggles, I figured that I might be on a lucky streak, so I also applied for the business card through FM’s link. Needless to say, I’m still batting 0% with Chase business cards.

On a side note, you need to hurry up and get some good credit card referral links of your own. Even if you’re not filling posts with them, have them listed on a separate page like FM. There are plenty of us who would go out of our way to use your links and help fund the continued travels.

I agree about the over all usefulness of flowers. lol

But it’s all conceptual, adding things up to get more miles. Now if you can do it for something useful, thad be great.

ah creditcards-shmeditcard, who needs em.

t sounds like you and your SO apply for the card. Can you pool the RR points into one account? If so, are there transfer fees?

No, you can’t pool your points together and count towards the companion pass. It’s a complete waste of money since it doesn’t count for anything and you can use miles normally. You would have to do it all under one account.

I don’t think you can pool southwest points between accounts but you can pool marriott points with a spouse which transfer 70000 marriott >25000 southwest. Not ideal but chase does have a 70k marriott card. You can also transfer 50000 hyatt > 30000 southwest.

My numbers may be off, this is from memory.

The best option with Marriott is if you have a ton of points and do the nights and flights. You can get 100,000 southwest points and a week of hotel for a little over 200,000 Marriott points. Something like that, either way it’s a great redemption. But it’s never been my strategy for Southwest CP as it requires a ton of points.

Hey Drew,

I just wanted to say thank you for this site. It’s a wealth of information for a newbie like me.

Also, congratulations on having an awesome life! Keep doin’ what you’re doin’!

I signed up through your affiliate link already and will continue to do so in the future when good offers pop up!

Thanks Austin. I think that’s the first congrats I’ve ever gotten on my lifestyle. So… thanks.

Also thanks for reading and the support in many ways, very glad to help in any way I can.

Drew – I’m currently 34k pts away from 110k SW pts and thinking of doing the flower deal and hoping to see some 9x-10x portal bonuses. I’m wondering if it’s to late in the year to accomplish as most of what I’m reading is that I need to have the 110k post in a calendar year. Should I just keep with the plan or am I wasting my time at this point? I currently have the personal SW card and Chase has denied me twice for the business card so that isn’t an option before the year ends.

Thanks in advance and I enjoy the site!!!

Man that’s tough. Real tough.

If you do the flowers thing, you better do it like right now. Like now now. Can’t guarantee they’ll post in time either.

Do you have a SO who can apply for the cards?

If it were me, I’d try to MS the rest this week. I can easily help you spend 34,000 on the card this week depending on where you live. You’ll be out a couple hundred dollars but it could be well worth it.

I was approved for both the personal & business cards. If I wanted to make sure I have the companion pass by Jan 1st, could I ask Chase to change my closing date on both cards to Jan 1st or 2nd? That way I could put $5k on each card in late December & have the points post on Jan 1st/2nd. Would this work?

Thnx for a great post!

I’m really nervous about giving advise on this and being wrong… So I would say try changing your statement to Jan 1 if it means the points would post sooner rather than later. Make sense? Because what you don’t want to do is assume “the points won’t post until later” and then for whatever reason it posts when the old bill would close and you get your bonus in December.

That being said, it’s worth a try AFTER they’ve posted in December.

And I have to ask, do you have a flight on the 3rd or something?

Haha, no travel on the 3rd, but with 2 kids & a trip we want to take over spring break, we want to lock in our tickets at the lowest point level, b4 point redemptions go up as it’s peak travel time. Maybe I’ll change the statement close date to the 7th to be safe. Thank you!!

I did this deal last January, and I’m thinking of having my wife do it for next year (we have kids, so 2 companion passes would “make sense”). That said, unless you’re already a frequent WN traveler, the pass probably isn’t as good as you think it is. Honestly, if you live near a US/AA hub, you’ll probably find yourself using Avios points much more often. The problem with this deal is that WN fares are just too darn high — especially at the times you’re likely to want to use the pass. Like try to get to MSY for the weekend at a price you’re willing to pay for the first ticket: I’ve been trying for almost a year now looking at WN fares and no luck (I think I’m going to break down and actually buy tickets on another airline).

The biggest problem is that it “wastes” two Chase apps and Chase WILL eventually determine that you have too many of their credit cards. As we all know (or should know) Chase has more great credit cards than anyone else. So are there 2 other Chase cards you’ll get more value out of than the WN cards? If so, don’t go for the companion pass.

That sounds like a winner of a plan, in my opinion. Good things don’t last forever, seize the day.

The thing is, I find myself using the things that would transfer to Avios on my international awards and what not. I always stretch my southwest points longer than Amex or Chase.

But that being said, it’s only as awesome as I think it is, if you’ll drain your points.

Must have nothing to write about today. When there’s nothing new to blog, out comes the good old Companion pass.

Believe it or not I have hundreds of posts not yet completed in drafts. Ideas aren’t my issue.

I just got to finish my “top 1,000 credit cards” series… that’s 1,000 posts right there! See, plenty to write about.

I just got the personal and business card and when the 1st statement closed I only had the annual fee on both to pay so I paid both right away and after a week I still do not show any points on Southwest. I guess they do not give you points for the annual credit card fee.

Drew – both my statements closed on Nov 10th and both the December statements show to close on Dec 10th so my plan is to pay both (I made a few small charges on both) on Dec 11th and wait to see the payment posted and then spend the $5001 on both since my January statement should close on Jan 10th also.

I called Chase CS and confirmed I have until Jan 7 on the personal card and Jan 27 on the business card to make the 2k spend to get the 50k.

Thanks for posting your statement here so I know my plan will work now.

You don’t earn points from paying bills, you earn points from spending money. Points will deposit if you don’t pay your bills, and you get no points for paying the annual fees.

But the plan of spending after the points post in December should be pretty solid as long as you understand what points posted from what card.

De nada, hope it helps. Yea, Jan 7 would be cutting it close. However, doesn’t that mean your statement closes on Dec 7 and Dec 27? Make sure you don’t spend money on dec 11 with a card that is going to try to post points on the 27th.

But it sounds like you’ll be watching for the points to post.

Anyone have experience with asking Chase to change the statement closing date so it is for the beginning of the (following) month, say Jan1 vs Dec 25?

As long as your first statement has posted, you can do it all online. Click ‘change payment due date’ and then make it 6 or 7 days later than what it currently is. If your first statement hasn’t posted, you’ll need to call in.

I am currently waiting for 2 recently approved personal cards to arrive tomorrow, so this is a timely and appreciated post! I understand that I need to have the bonus points post after Jan 1, but I am still unsure as to the ideal closing date to set up for my account(s). It looks like you are saying Jan 1 works as a closing date if you want to do the spend in December. I will probably try to set it at Jan 7 just to give myself a little buffer room.

Assuming this means that I shouldn’t start putting any charges on my card until after my first closing date in December? This is a shame since I have a $1400 final payment travel bill due tomorrow. But if I put that on my card tomorrow, am I correct that it will count towards my min spend needed for the 50K, but not the extra 6K I will still need? I hope this makes sense. It’s late and I’m tired!

Yes, you’re correct that the $1,400 would go towards meeting the $2,000 minimum spent (for the 50K points), but it would not count towards the extra 10k (110k CP – 50k CC – 50k CC) you need to fill the CC points and CP gap.

You could just put the charge on one of the cards and then not use it until after the billing cycle, but I’d probably hold off until using it until that point anyway. Like you said, the 1400 points wouldn’t go towards the 10k you’ll need, and you may have other places to allocate points. Although if you’re going for the CP, SW points are worth 2.8 cents (1.4 cents x 2 tickets), so that’s a pretty good value anyways.

I would, however, for sure recommend using the SW card if you are worried you may not otherwise be capable of hitting the minimum spend on both cards.

Thank you for the input, Jonathan.

Just a data point, I signed up for the plus personal card about 10 days ago, then the premiere today (3 days after activation of the plus). Both were instant approval. Never had either card. Btw used the link on this site for the premiere, Drew deserves it….

Technical question… My husband signed up for the Premier cards 2 years ago in November. I’m thinking he can sign up now for the personal and business Plus versions without worrying about the 24 month issue for getting a new bonus, right? Otherwise, he should wait until January (after his bonuses posted on the Premier cards 24 months ago) to resign up for the Premier, right?

Thanks for all of this! Quick question – would this work for applying to the Plus and the Premiere personal cards? Would I get the ESB for both? (Just wondering since I don’t have a business…)

Does the RapidRewards account that you deposit the miles/points earned from the Chase card have to match the primary cardholder’s name? Was thinking of getting the credit card in my name and having the rewards (and ultimately companion pass) linked to my wife’s RapidRewards account.