Last calendar year we managed $296,874.42 in Airbnb + Homeaway revenue (full screenshots below), and during our current 24 day vacation we rented out our personal apartment for a total of $5,985.35 (and our rent is $1,600/mo).

I’ll have a follow up post about our strategy of renting out our personal home while traveling, because in my opinion, planning a vacation at a time when you can make $6,000 is way more beneficial than earning a ton of miles to save on flights (especially when our last flight to Europe was a paid flight for $200 each way).

(If you haven’t signed up yet, you can use my link here (thank you!) to get $55 off your first trip. But you can start listing your place and I’ll give more tips on how we manage our home while we travel).

However, this post is about our adventures of buying a property for Airbnb, renting properties for Airbnb (arbitrage), and managing Airbnb properties for others. (Oh, and misadventures).

It will include the following sections:

- Market Analysis

- Why Real Estate (buying) is Better Than Travel Hacking (or stocks)

- Renting Arbitrage vs Buying

- Furnishing / Decor

- Automating check-ins and check-outs

- Automating cleanings

- Automating pricing (and how I price)

- Policies for dealing with guests

And much more!

(This is by far the longest post I’ve ever written (with the help of Carrie, btw), because I wanted it to be great, but since it’s a travel blog I didn’t want it taking up 10 posts. This covers everything from beginner strategies, like what our automated messages say, to super-advanced strategies like investing in places with multiple units, so skip to the section titles most intriguing).

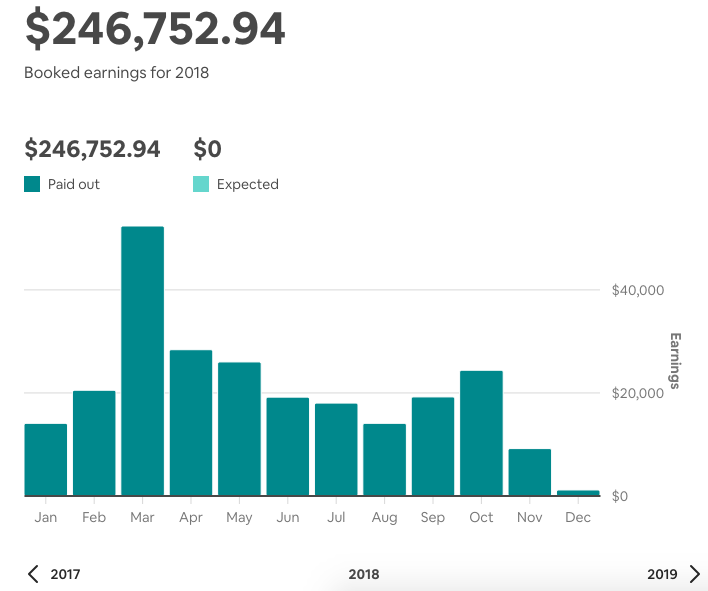

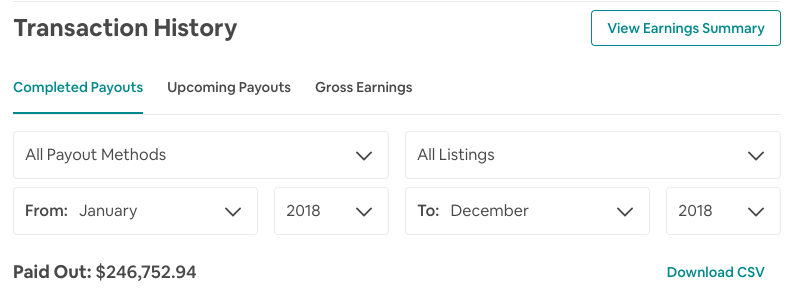

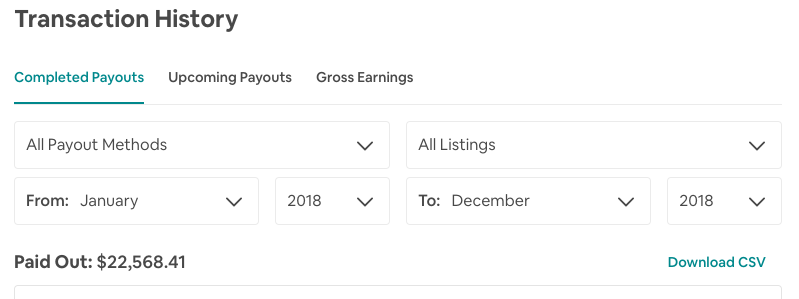

2018 Revenue Proofs

Carrie’s Airbnb account revenue for 2018:

My Airbnb account revenue (where we kept a property with bad reviews) for 2018:

Our Homeaway account revenue for 8 properties in 2018:

Expense Guestimates For Rentals

While I’ll talk about owning, the revenue shown and the expenses below are all for properties we rented in Austin. Maybe of them were not up for half of 2018, some were started and some were shut down during the year. But it gives an idea, hopefully, of what we were dealing with.

Also, as we’ll mention, we recouped 70% or more of the furniture investments when we sold off 6 houses of furniture.

- 2 bedroom properties:

- ~$1,700/mo rent

- ~$200/mo in utilities

- $40 per cleaning (1 – 2 times a week)

- ~$2,000 in furniture per property

- A 1 bedroom property:

- $1,150/mo rent

- ~$200/mo in utilities

- $40 per cleaning

- ~$1,400 in furniture

- Property G:

- $2,650/mo rent (utilities included)

- $50 per cleaning

- ~$3,000 in furniture

- Property H:

- 6 bedroom

- $3,000/mo rent (was half off and 9 month lease)

- ~$400/mo in utilities

- $100 per cleaning

- ~$3,000 in furniture (+ borrowing furniture after)

- Property I:

- 4 bedroom

- $2,300/mo rent

- ~$350/mo in utilities

- $90 per cleaning

- ~$3,000 in furniture

To be clear, I don’t have good furniture records and didn’t feel like digging in Carrie’s spreadsheets, so these are estimates.

Also, this does not include many other expenses that came up (although I’ll give full details on a specific property later).

Other expenses include:

- Cockroach treatment every quarter (it’s completely unavoidable in Austin).

- Refunds/compensations due to complaints.

- Replacing sheets and linens.

- Cleaning supplies and amenities.

- Many repairs ranging in size.

On one property we have $1,000 in extra expenses for the year for example – everything from trash-bags to paying someone to run and get something on Favor.

Market Analysis

I’ll give the tools for how I research, and then I’ll show the results of my research.

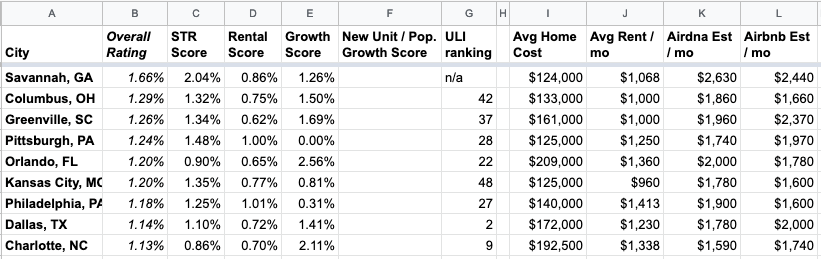

Here is my spreadsheet, although I’ll discuss the details of this in a minute, it will give some context.

Resources for short term rental (STR) revenue:

- My spreadsheet

- Airdna’s post on the Best Places To Buy Vacation Rentals. But it only shows 100 big markets.

- This 2018 post is a better visual display.

- Airdna.co –

- Also, you can pay for a specific city and cancel after a month.

- This page on Airbnb gives an estimate.

- Look at people’s calendars on Airbnb!

- Nothing beats watching the Airbnb market yourself. If someone has lots of revenues and every weekend are unavailable, and all the weekends are listed at $300/nt, that’s a good indication that those weekends are booked (not just blocked).

For buying, you can browse Zillow, Redfin and other free resources.

For multifamily and “commercial” sized properties you might have to check loopnet.com, realtor.com, and Redfin.

My Philosophy:

- Buy in a really low-cost market. It has benefits beyond price of the house, like cleaning.

- Buy in a city with high estimated revenue.

The reason Airdna’s posts only show 100 markets is because they don’t want to show you markets with 1 or 2 listings, because that 1 listing could be a unique castle, or something bazaar. They want to show you an average.

But I want a market that seems to have high demand and low supply. - In a small market, buy a 2 or 3 bedroom. In a big (/high demand) market, buy a giant house.

- Big houses are in a market of their own. In Austin, it could be a frat party, or often companies that have big groups, and even $500 a night is cheaper than 6 hotel rooms downtown! And people like being together.

- When you searched many weekends for 6+ bedrooms in Austin, our campus place was often one of the only places downtown, and thus it got booked all the time.

- But in slow times where you don’t have tons of big groups looking, the place went empty for long periods of time. Its revenue and profit were great, but its occupancy rate was low.

- Thus, in a low-supply market, you don’t need a distinguishing factor (like 6 bedrooms).

- The way to make killer money is when the market supply is completely stripped.

- In Austin, SXSW or Austin City Limits are big enough festivals that if your property is downtown, all your competitors will sell out. Our 2 bedrooms last year all went for $800 a night for SXSW (it also helps that people were there on “business” and corporate was paying for their houses).

- In a small town with only 100 Airbnb listings, supply might more easily sell out because of a University ball game, a conference center / big events, or just because it’s a vacation spot. Our house has all 3 all the time, and that’s where the real money is at – when rooms completely sell out.

Again, Here is my spreadsheet.

For the second tab I identified specific properties I would buy downtown instead of using market averages. I find doing this for yourself is the most accurate strategy. Buying a big property in Pittsburgh, for example, is quite reasonable, and might have a big multiplier in the STR revenue estimate.

This is just an example of the kind of analysis I did before buying.

I went a little too nerdy on this. For example, I weighed in population growth, since there is a strong correlation to property prices over time and population growth over time.

But really the most important aspect is the ratio of STR revenue to real estate prices.

I included long term rental averages as a fail-safe, in case a city bans STRs (although both cities we have properties in have banned STRs) or the STR revenue is worse than I expected.

Yet, from all my research, STR revenue has always been higher than expected. Always. Friends that have bought in the mountains or the cities, all have better revenue than my research would have indicated. Thus, I’m no longer worried about this.

Of course, I and my friends did purposely buy in an area that we thought would do well on Airbnb. But my sister-in-law’s family got a cheap property in the middle of nowhere Texas (I mean truly a place you have never heard of, nor want to go), and they are killing it with short term rentals. It was a planned thing, they just had a family property that they rented out to oil workers, and that worked so well, they put another unit on the property… and then another!

I’ll never buy a fixer-upper again!

A “fixer-upper” is a great way to potentially get a deal, however, there are way more unknown variables than you can possibly predict.

And my philosophy is this- if a house has been neglected/mistreated in one area that requires immediate renovation, chances are other parts of the house will eventually reveal issues from neglect/mistreatment and demand renovation down the line.

In our case, the inspector found issues that we priced out. However, there were issues he was incapable of seeing or things that broke after we bought the house.

Why you should consider buying anywhere, not necessarily near you.

I am a very strong believer that you should not purchase a house because you live there, you should measure objectively compared to anywhere.

I live in a great city for STR, Austin. But if I had bought a property in Austin the same house would have cost literally at least 5 times more, and the revenue is exactly the same.

Why in the world would you want to have 1/5th the profit?

The answer I always get is, “well, if something goes wrong, I want to be able to fix it myself and save money.”

Really?! You would rather have 1/5th the profit because you want to do more manual labor?!

That’s odd to me, because not only would I probably not save money by doing repairs myself, but I’d rather have 5x more money to pay someone else to do it.

Hmm… Would I rather have more money and do less work, or make less money and do more work? Geez, tough!

Plus, my new philosophy is to minimize repairs by buying a house in great condition. A brand new centrally located home in Austin would literally cost 5x to 10x more than the markets I identified.

And the best part is that labor is cheaper in these markets. Cleaners on Craigslist quoted 5 times more. So while I made the mistake of buying a house that needed expected repairs (and the repairs went way over), when I did have an unexpected major plumbing issue, the price was way less than way more minor repairs in Austin would have been.

My friend bought his first STR property and it was in a different state, and his first month’s revenue (which was a partial month) was $7,000. In the city he lives in, the same property would’ve cost twice as much, and the revenue would have been half.

Now he has extra revenue to pay other people to do 100% of the work.

He must like the not doing work strategy because he bought a second house in the same location (states away from his home) a few months later.

Again, the goal is to automate all this. It’s hard to have money to pay other people when your margins are tight.

The Single Multi-Unit Strategy

As I mentioned, big houses sometimes bring in big multipliers because there are no competitors!

However, sometimes big houses have low occupancy. A friend told me once, “be careful with big properties, they have high highs and low lows”, but I had no idea how right he was.

Then I got an idea in my head with the duplex – list it as two separate 2-bedrooms, or one single 4-bedroom unit.

Then we got the identical duplex next door and I had another idea: also list the two duplexes as one single 4 bedroom property! I only thought of this at the end, but it was the best idea I had.

And despite being in two different houses, people liked it! I mean, where else could they get 8 bedrooms downtown anyways?

But the best part is that during the winter slow months, the small version of the listing got booked, and in the peak months, the big version of the listing got booked at a premium.

It’s perfectly complementary for a few reasons:

- Get the high revenue of the big place in peak seasons, and the occupancy rate of the small places in low seasons.

- Big places often book way in advance and never last minute, and small places tend to book last minute.

- Big places book at a premium and I keep my prices higher further in advance.

- Even if the big unit wasn’t more than 4x a single unit price, it still meant all 4 places are booked!

- Simply put, you are going to show up in the search results more often and it means you have the maximum number of views, and therefore higher bookings.

As you’ll learn, the 6-bedroom went for $2,000 a night during SXSW and was booked further out! Win-win.

But as you’ll see with the revenue/expenses spreadsheet in the “Campus Strategy” section, the problem is that it was literally unprofitable for 4 of the 9 months. Negative profits for half of the months, and one was barely profitable!

Yet, it was still one of the most profitable places overall!

But as you’ll see in the next section, the same slow months averaged nearly $1,000 profit a month with a 2-bedroom!

What if we could have turned that 6-bedroom into three separate 2-bedrooms? The idea of the big $10k profit months, and the steady occupancy is something I want to perfect!

My idea for the perfect Airbnb strategy (besides buying in a low-cost places where the rooms completely sell out), is to buy a giant place that can be divided into multiple units.

We looked at buying a property that was a 6 bedroom that had a 2 bedroom guest house (and man, now seeing revenue on a 2 bedroom, I kick myself for not making that sale happen)…

The best strategy would have been to list this place as a 6 bedroom and 2 bedroom separately, AND also list it as an 8 bedroom place.

The great thing is that Airbnb allows you to sync calendars and make it so if one unit books, it automatically blocks the 8 bedroom, and vice versa. Then, it also lets you nest a listing within a listing. Essentially this means you can link/nest calendars in up to 3 tiers. For instance, a house which contains an upstairs and a downstairs duplex, can also contain a guest bedroom. That’s 3 tiers. House 1 includes unit 1 and 2 which includes room 1 and 2.

In my mind, the perfect strategy is buying a property (in one of the prime markets) with as many units as possible that would make sense separate or together.

For example a four-plex with a shared entrance.

The Biggest and Bestest of the Single Multi-Unit Strategy

My BIG idea is to buy a large piece of land downtown in a market I’ve already proven to have demand, and build 8 tiny homes. Even though it’s downtown, I earlier identified a property that had 8 subdivided lots downtown with lots of greenery for privacy.

This way, I can rent it out to groups of any size. A group wanting 4 rooms could book a listing that blocks off 4 units, and then I could rent the other 4 individually or as any size. It is the perfect Airbnb strategy as it can show up in every search result and meet all demands optimally.

(I actually detailed a way to do this all very cheaply but it’s hard to convince investing partners to do a big crazy idea with you in a lame town, but now I’ve proven this, hopefully, we can still do it).

Real Estate = Better Than Travel Hacking

I recently saw a “business guru” write about how real estate is an objectively worse investment than stocks, yet skimming the article it was clear that he was comically ignorant of all the benefits of real estate, making the math obviously one-sided.

Summary of Real Estate Hacking:

- In real estate, you can use your credit and leverage to make the investment. With stocks, you put in 100% of the money to get the value of the stock… But in real estate:

- At most, you generally need 20% of the cash to get the full value of the investment.

- USDA loans are 0% down. In rural areas you can buy a house for near $0, and it’s odd which areas are considered “rural” for this qualification. You can buy a house a few miles near downtown Austin for example.

- VA loans (for veterans) are 0%.

- FHA loans are available to people with a credit score over 580(!), often require only 3.5% down(!), and you can buy up to a 4-plex building!

That means the average person can buy a $500,000 4-plex for $17,500, and start renting out 4 places!- Legally you have to live in the house for one year (halfway to tax-free!), although a friend seems to read it as the majority of the first year, and therefore 6 months. Look up the rules yourself, don’t get all your loan/tax info from me! Please!

- Crazier: For commercial buildings (larger than 4 units), banks set the loan not based on the purchase amount but revenue. Many, many, many people find apartment buildings with low rent or low occupancy, buy them (there are no-money down ways), and then fill the places. Then they go back to the bank and refinance at double revenue, and the bank will pay out double.

My friend bought an apartment building (with a private loan), doubled the revenue by filling it, got a traditional loan for double what he paid, paid his investors back, and pocketed the rest of the money (which was a fair amount!) and rented it out profitably!

- The Government incentivizes real estate investments with taxes. Besides the fact it’s already counted as capital gains tax, there are other discounts:

- If you live there for two of five years, you pay zero taxes (0, nada, zip).

- You can use a 1031 Exchange to invest in another property and pay zero taxes.

- One of the craziest real estate rules is that you get to claim depreciation and write off the value of the house (value – land (and our land is worthless)). Most common is to deduct the value of the house over 30 years.

- There are many other tricks including everything from how you use your IRA, trusts, s-corp, to writing off your mortgage interest, repairs… everything!

I would go on and on, but this isn’t a post on buying properties. I’m simply mentioning that you can get paid to buy a property that then continues to make money, and get a huge tax break… and with zero money to start.

I’ve never heard of anyone buying a ton of stock with no money, and then instantly pulling out 100% of the value in cash, and still benefiting from the stock increase… Yet, it happens all the time in real estate.

Perhaps I could convince my buddy to help me write a more in-depth summary of his successful real estate hacks (it’s more impressive than any travel hacking story I’ve heard). But there are lots of resources out there, for example you can read or listen to the podcast of BiggerPockets.

Renting Arbitrage

We started this experiment by renting out our home in Austin, TX when we traveled. We left town for March and April and made exactly $7,687, when our rent and utilities would’ve totaled no more than $3,600.

Granted, we live downtown and March is SXSW, which we now know is the biggest money earner. But the fact that April was also really profitable was an interesting dilemma because it made me feel like living in my house was costing me money.

So we asked our landlord to rent the other half in the duplex we lived in, in Austin, TX. We told her upfront what we wanted to do and she gave the go ahead.

Over time as the neighboring places she owned became available we rented those too. Eventually, we had 6 properties on the same block – 5 two-bedrooms, and a one-bedroom.

In our first 8 months (I’m showing just because we already had the spreadsheet filled in for those months), we made $10,546.10 in profit.

| October, 2017 | November, 2017 | December, 2017 | January, 2018 | February, 2018 | March, 2018 | April, 2018 | May, 2018 | Total | |

| Revenue | $3,546.32 | $2,920.67 | $3,971.44 | $2,810.09 | $2,296.48 | $6,588.46 | $3,394.75 | $2,475.93 | $28,004.14 |

| Expenses | -$1,922.65 | -$2,043.16 | -$2,157.66 | -$2,222.42 | -$2,109.24 | -$2,443.65 | -$2,352.56 | -$2,206.70 | -$17,458.04 |

| Net Total | $1,623.67 | $877.51 | $1,813.78 | $587.67 | $187.24 | $4,144.81 | $1,042.19 | $269.23 | $10,546.10 |

Expenses include all monthly expenses like utilities, rent, cleaning, etc… However, it doesn’t include the cost of furniture, which was generally around $2,000.

Also, know that in Austin summer is nearly as slow as winter, so the next few months wouldn’t include a ton of extra profit.

The Key To Renting Arbitrage

Most of this will sound obvious, but it’s a lot easier said than done, and I think we got lucky living in Austin.

A few keys notes:

- A market with airbnb demand significantly higher than rent.

- Below market rent.

- An owner motivated to let you manage everything.

- A property in a good location.

- A property in good condition.

1) Market.

You might not be able to change where you live based on Airbnb income, nor should you.

But I think you would be very surprised which markets do well. The house we own is in a small lame town in Texas and it seems to be doing very well on Airbnb.

I’ll talk about market research in a minute.

2) Below market rent.

I believe a lot of people are setting their prices based on their expenses. If people aren’t profitable then they have to quit or raise their prices.

To get below market rent you either need to: be creative; know an owner who doesn’t want to manage their properties anymore; or you simply watch craigslist everyday.

3) A motivated owner.

You need to get the owner’s approval, and not everyone is okay with Airbnb. Most owners seem to have the delusional opinion that short term renters cause problems and long term rentals don’t.

My pitch to an owner is simple:

- I’m financially motivated to keep your property in tip-top shape.

- The place will get professionally cleaned weekly!

- Once I have the place furnished and am making money, why would I ever not renew the lease?

In addition to that, what I would tell someone nervous about short term vs long term rental is that I’ve heard horror stories of damage either way… But ALL long term rental owners eventually have to chase down checks from tenants. But payment with Airbnb is done when they book, and the payment is sent to you the day they check-in! It’s amazing.

4) A property in a good location.

The money maker on Airbnb is when the supply of available properties sells out completely.

One year for SXSW we were able to charge $2,000 a night(!!!!) for our 6-bedroom in downtown Austin, because all the other places in our area that could accommodate groups that big were sold out. Plus, all the other ones a little further from downtown were charging $3,000+ a night because there were so few places left. We easily got that place booked!

5) A property in good condition.

Our old properties were a nightmare.

There are 4 great reasons to never rent an old crappy property regardless of price:

- Complaints, refunds, and cancellations will kill your profits! Trust me!

- Reviews hugely affect your rank in the search algorithm. You want a perfect 5 star review, and you can’t do that when stuff doesn’t work and guests see mice or roaches or smell must. Trust me!

Also, your account ranking matters a ton. So one bad property could hurt all your other properties. - It’s not nearly as automated when you have to deal with complaints and fix things all the time.

- Big things break in old properties. AC/heat, plumbing, even roofs! Your landlord is not as motivated to fix things as quickly as you, and might not be responsible to fix minor things guests complain about.

Just trust me that we have lots of experience with all these things.

Why I Will NEVER Rent To Arbitrage Again

- The landlord not making repairs costs us a ton of money. A ton. And it’s sunk costs.

- Lost deposits for no reason

- Owner quits/sells/etc

- Volatile landlord

In short, the 6 houses we had with one landlord had serious issues and she wouldn’t fix anything or respond.

For example, we had a leak with a bathtub in an upstairs unit and it started leaking through the ceiling of the downstairs bathroom. I texted her multiple times over the next few months until it got really bad and spawned a cockroach infestation, at which point we just fixed it ourselves out of pocket.

That is one of many examples of her negligence (and our neighbors before, (previous tenants of hers), all had crazy similar stories). There were tons of issues, like a tree broke the roof and put a hole in it and she lied about fixing it. Oh also, we got a letter from the city saying she couldn’t rent out the house due to a plumbing issue and she made no attempt to fix it.

But the craziest part is that we’ve now moved out and she has not given back our deposits ($7,600) and didn’t even reply as to why (I’m guessing they don’t have the money, hence not fixing the house ever, and they’re currently renting their houses without gutters or city approved plumbing!). And I should be clear that we put money into these places fixing them, because things were broken and they don’t care.

Now, when I get back to Austin the first thing I’m going to to do is move forward with a lawyer to start legal action to get our deposit back (which I want to be the only time in my life I sue someone). Luckily, based on our research, we will 100% certainly at least get 3x our deposit… But still, what a pain.

But the point is that when your landlord won’t fix things you have to pay out of pocket, you get bad reviews (which is bad for future profits on your account), and you lose money via cancelations and refunds.

Why My Friend Is Making A Great Living Doing The Same Thing

However, I have multiple friends who have been renting from good landlords and have been renting from them for a very long time, and they are making way more money.

With all of my friends they have a great deal on rent, and have been renting from the same person for a long time without raising rent. It’s a win-win because they literally never have to deal with their property ever and they have had no turnover for years!

As a landlord, never having to deal with turnover is huge. They literally don’t have to do any work, and I’m guessing the houses are paid off and from their perspective, it’s just a work-free income.

If you are just scouting craigslist, be patient! To make this work, you need a great deal, and a mutually beneficial set up that will last a long time. The model won’t work if you’re changing houses every year, except for the strategy in the below section, which is just a strategy/idea for getting a rental deal.

We also had a great deal with a different owner, where both parties were very happy. But… Austin being as expensive as it is, after a year he decided it was a great time to sell (totally can’t blame him!).

If you don’t get a sweet deal and a long-lasting relationship, you’ll burn out!

The Campus Strategy: The One Renting Exception (an idea for discounted rent)

We actually got this 6 bedroom I referenced earlier for half rent, $3,000 a month instead of $6,000 a month.

The reason is that this big house on campus is intended for big groups of students, and student group rentals are always pre-leases.

When a house is pre-leased for next year, and the current school year has already started, owners are desperate to fill the place. Who else would want to rent a 6 bedroom house for only 9 months?

Due to some construction, this house wasn’t listed for rent until fall and was already rented out for the next year.

Results

Here are our monthly expenses:

| November, 2017 | December, 2017 | January, 2018 | February, 2018 | March, 2018 | April, 2018 | May, 2018 | June, 2018 | July, 2018 | ||

| Revenue | 3533.71 | 4417.38 | 5703.6 | 14302.36 | 5903.42 | 6975.62 | 4782.1 | 4063.33 | 49,681.52 | |

| Expenses | -1275.47 | -3562.62 | -4445.01 | -3863.53 | -4175.2 | -4070.79 | -4091.17 | -4150.09 | -4126.43 | -33,760.31 |

| Net Total | -1275.47 | -28.91 | -27.63 | 1840.07 | 10127.16 | 1832.63 | 2884.45 | 632.01 | -63.1 | 15,921.21 |

That is $15,921.21 before furniture expenses and deposit.

With at least $5,000 in furniture, and then $600+ in moving expenses, and they shorted us over $1,000 in the deposit (claiming it needed painting (but I have before and after videos that make it clear that the walls are exactly the same, but it’s not worth the fight)).

So assuming we lost $7,000, that’s only $9,000 for a lot of work!

However, this is a totally awesome strategy if you have a plan for what to do with the furniture after the lease-end. Say you plan to buy a house next year, or have a giant garage to store stuff in and continue to look for another deal over the summer.

Then it really is closer to $15,000 in profit for 8 months of work. And by 8 months, I mean two terrible weekends.

However, you should really go into it informed about the costs and revenue estimates of your area!

Again, this is just an idea for getting a deal. If you can get a deal and not have to move every year, that’s better!

But here’s the big variation I’ve been thinking about…

Notice the majority of months were unprofitable? The vast majority of the profits came in March, because of SXSW.

What if I could sublet a place during peak season? In some places, summer is peak season and most all students are gone. That seems like an opportunity.

SXSW is usually during spring break, that’s an opportunity.

On the other hand, I can’t find a way to rent furniture, like from Cort, and keep profits. The benefit of Cort is that they move all the furniture and set it up, before and after… But every time I run the numbers, it kills near 100% of the profits.

Also, I think it’s very very important to be upfront about what you are doing.

Furnishing A House

My strategy is simple: quality and price matter a ton, but buy as cheaply as you can so you can sell it off for the same price.

We got rid of the original six properties I was mentioning recently and we sold all the furniture in two weekends and made about $8,000 (guesstimating ~70% of our furniture costs recouped).

Our strategy was to do a big “open house” style yard sale. We made a sign and posted about the yard sale online, and posted each item individually online (Facebook marketplace, craigslist, and various selling apps) with a note in the description that we have 6 houses of furniture for sale. We gave the address and stayed there all day Saturday and Sunday for two weekends. It was crazy, but for $8,000… it was worth the four days of work!

Items we deem essential to meet guest expectations:

Bedroom

- Beds with high sleeping capacity in mind.

- 2 matching night stands per bed, or 1 for twins.

- Bedside lamps with outlets or USB ports in their bases. (1 per nightstand).

- Something which luggage/personal items can be set onto. (Most often, we use storage ottomans and place them at the end of the bed.)

- A small trash can

- A rug if there is no carpet.

- A full-length mirror (in at least one room of the house).

- At least 2 sheet sets for each bed (in a standard color that will match any room decor.)

- A comforter with a duvet cover. (Try to keep 1 back up duvet cover per bed size. Full and queens use the same size.)

- 1 pillow per guest based on the occupancy you advertise.

Kitchen:

- A kitchen table (or multiple tables) with enough seating for the occupancy you advertise.

- A coffee maker, coffee filters, and coffee grounds

- A microwave

- Enough plates/cups/bowls/silverware for the occupancy you advertise.

- One or two large pots, one or two frying pans, a baking dish, a cookie sheet, a tea kettle, a few frying spatulas and serving spoons, a cutting board, several kitchen knives, a large mixing bowl, an oven mit, a few dish towels, a can opener, and a corkscrew.

- Dish soap and dish sponges.

- A tall kitchen trash can (with back up trash bags).

- A dust pan and brush.

- Paper towels

- Extra smoke alarm batteries and light bulbs.

Living Room:

- Living room seating for the occupancy you advertise.

- A coffee table

- A tv with Roku.

- Throw blankets (which can be used as spare blankets).

- A rug if there’s no carpet.

Bathroom:

- Large bottle of body wash, shampoo, and conditioner. (We use the bottles with the dispenser-style tops.)

- Hand soap

- Plunger and toilet brush

- Washable bathroom rug. (With one spare in storage).

- Standard surface cleaner and toilet bowl cleaner.

- A trash can.

- A hair dryer

- An iron

- A small, hangable or “countertop” ironing board like the ones they sell at Target.

- One towel and washcloth per guest based on the occupancy you advertise. (We try to keep spare towels and hand towels in a somewhat discrete storage area, otherwise guests will use as many towels as they can find. Expect to replace these several times a year.)

- Hand towels.

Extra Linen / Instant Turn Around Strategy

Our strategy was to have a ton of linens and towels, that way, worst-case scenario, our cleaner could run in and swap all the sheets and towels without doing any laundry, if need be.

Where we shop:

- Big pieces of furniture were mostly purchased from a Salvation Army in north Austin. It is by far the largest selection of furniture I’ve ever seen from any thrift store ever.

Prices for big pieces were roughly as follows:- Couches for $200 or less.

- Kitchen Tables for $300 or less.

- Beds varied greatly from $100 to $600.

- Craigslist/Facebook Marketplace/Offer Up for coaches, tables, and rugs.

- Linens + Towels – the cheapest I’m sure is Walmart, but we tend to buy from Amazon Warehouse Deals, just because we buy used and don’t own a car, so it’s nice to ship it directly to the house when you’re ordering so much stuff.

- Beds on Amazon. I now think Amazon is the best way to buy beds – no driving around, filter by rating, great prices. You don’t really need a headboard if you decorate well and get nice decorative pillows and duvets.

- We got this bunk bed on Amazon Warehouse Deals for $300 and it looks amazing and took me all stinking day to put together. Yet, it’s so nice I would consider doing it again. (This one looks easier, though)

- We have this mattress in our guest bedroom and everyone loves it. I meant to get a 12″, which looks fuller, but since people are happy, I’d get this one again.

- Also just check Amazon Warehouse Deals.

- Accessories from thrift stores or Amazon.

- Plates, bowls, mugs, and cups are soooo cheap at our local thrift stores that it’s a no brainer, although it’s hard to find silverware.

- This electronic deadbolt on Amazon

- Guests definitely prefer self check-in, and this will make your life way easier too. We install electronic deadbolts in every Airbnb and this electronic deadbolt is our favorite because the unlock and lock occurs manually after the code is entered, which minimizes some user errors and alignment issues.

- This bedside lamp on Amazon

- This is by far my favorite lamp because it’s two 3-prong outlets and it’s metal.

- But it’s often sold out or expensive, so here’s the cheaper alternative.

Buying beds on craigslist is hit/miss. Multiple times we didn’t notice the bed frame was broken in some way until setting it up. Just isn’t worth it to me, plus some people don’t show mattress stains in the photo, so you have to drive 30 minutes or more to find out.

Proof That Making Your Airbnb Photogenic Matters A Ton

In short, my mom came and visited our property while we were making some repairs, and we gave her the liberty of decorating the place with a thrift store budget…

And our ratings and bookings went way up!

We literally had people complain about the decor, and we had a cancelation from not liking the house (a bad start!). But since her makeover it’s all been good.

Specific Decor Recommendations

Minimalism is fine, but guests will notice and even complain if decorations are too sparse. For nondecorators like me, here are some tips:

- Try to stick to color schemes that match throughout the entire house so that the decor is not dependent upon guests and cleaners keeping blankets, pillows, etc in their original locations.

- Nice duvet covers go a long way towards looking nice (and are easy to clean).

- Throw pillows also go a long way to making things look decorated.

- You can get away with non-decorated bathrooms and kitchens, but every other room should have some sort of wall hangings and small decorative pieces.

Pricing (automating, and my specific strategy)

Tools:

- Never ever ever use Airbnb’s suggested pricing. It is objectively terrible. They probably just want it to be as cheap as possible so more people use Airbnb. For example:

- For SXSW next year, when our 2 bedroom goes for $500 to $900 a night, Airbnb recommends $149 a night. I kid you not. For a 10 night festival, you would be losing $3,500 to $7,500… For a week. That is a major loss for being lazy and using Airbnb’s pricing.

- Pricelabs.co

- Using a competitor that takes a percentage, like BeyondPricing, is lazy and dumb, unless your revenue is relatively low, like an average of $2k or less.

- Pricings are based on your “base rate” that you set. So it decides how much certain days have multipliers in either direction and dynamically increases the price based on that “base rate” you set. Thus, you have to adjust the rate accordingly – check “my pricing philosophy” below.

Ultimately, none of the automated pricing tools I’ve tried are great at peak pricing, like during SXSW. Nothing is as bad as Airbnb’s recommended pricing, but they still will under price. Even though I’d rather under price and get booked than over price and not get booked, I’d rather not lose money.

Therefore, I still check for peak weekends.

My Pricing Philosophy

I want to be the cheapest rate for my general category 1 month out.

- If I have a 4 bedroom that can host 12 people, I’ll search each weekend for a 3 bedroom that holds 8 people.

- If I have a house 3 miles from downtown, I’ll search downtown to 4 miles away.

- At least 1 month out I redo this search for every weekend

- I can do this pretty quickly just by quickly changing the weekend dates and using the filter to see what’s around.

- If I see places with 1 star reviews, no photos, or no furniture (which happens, or sometimes it’s just a campground), I’m obviously not trying to underprice them.

- If you have great reviews and a great location, you can win being $10 cheaper than the competition. If you are way out of town and it’s a shared bedroom, you have to be way cheaper.

Know that I now have moved away from using any pricing tool and simply update periodically instead. Mostly I set kind of seasonal weekend rates (spring and fall are way higher in Texas), and then I make sure I check a month out.

Especially two weeks out I start knocking down the prices, sometimes almost daily. I just log on and knock it down $10 every couple of days until it’s booked.

My experience is that the bigger the place, the harder it is to fill weekdays.

Weekdays are already tough, but a 6 bedroom in the spring might go for $600 Thur – Sun and then go completely empty during the weekdays in between at $99 a night.

What I do is keep the weekdays at a medium price, not super competitive, incase someone books a week. But once a weekend is booked, I then knock down the weekday prices.

Discounts

- Weekly / Monthly discounts depend on the property and how it’s filling up.

- If it’s a great location, your goal is to sell peak weekends and fill the week days.

- If you have a bedroom in a not great location, your goal is to have a low price and high occupancy.

- I’d start low, at most I’d say 15% weekly, and 25% monthly, and as you learn about your empty weeks you can adjust.

- Last minute discounts are important. If your place isn’t booked 1 week out, don’t worry, 25% of people look the week of… But you now have less chances and other prices are falling, so yours should too!

Back to Big vs. Small Places…

I now believe that the advantage of big places is that there are few real competitors and it creates pricing monopolies. Hotels just can’t compete on the convenience of having a big group in one place.

However, hotels don’t try to compete on the pricing of small places. Looking at Airbnbs for a month in Mexico City I could find comfortable places for $1,000/month. But when I looked at hotels, a place that would have been the same $80 for one night, is still $80 a night for one month… Which ends up being $2,400.

Nightly Minimums

We stick to 3-night minimums unless there are gaps we are trying to fill, or a partial weekend open, and then we do 2-night minimums.

We rarely do 1-night minimums, because those are the people who throw parties.

Plus, you don’t want a 1 night booking 3 months out, that now breaks up an otherwise great weekend booking.

You are way more likely to get a 3-night booking checking in Thursday, than a 2-night booking checking in Saturday!

So don’t dip below your 3-night minimum unless it’s last minute or to fill a gap. (You can automate changing your minimum for gaps or last minute bookings with Pricelabs.co).

The reason I don’t have higher minimums is that the majority of our bookings (in Austin at least) are weekends. For other places, you might be able to only have week+ stays, but at that point just price accordingly – have your weekends priced higher so you’re happy if you get a 3 night, and your discount high enough to attract the weekly stays.

Dealing With Damages, & Concerns About Partiers

Sure, partiers can be a concern, but don’t stress so much- a major issue is super rare. We’ve had vomit in the bathroom and beer all over the kitchen floor. We simply pay our cleaner double, and know that it’s part of the game, and we don’t even ask the guest for more money in most of those cases. (We want to avoid “revenge reviews” for guests unhappy about getting charged for extra cleanings. Besides, we set our cleaning fee slightly higher than the amount we pay our cleaner to account for occasional fluctuations like these.)

In case of damage, keep receipts for everything!

If you had to clean up vomit, Airbnb isn’t going to pay you anything for your trouble. But if you had to hire someone, and you have a receipt linked to their behavior, Airbnb will likely make them pay or cover it.

In my mind, it goes back to the advantage of doing nothing yourself. In case of the emergency repairs, you won’t save money by doing it yourself.

For instance, we did have 1 guest throw a party and break stuff and we handled a lot of the clean-up and repairs ourselves, but when Airbnb asked for receipts we didn’t have much to show them other than photographs of the damage.

However, later, a guest broke a window and we instantly paid a window repair person to come out, and it was completely covered (actually willingly by the guests). All because we were able to provide a receipt with our photographs.

Those are two of the biggest parties we’ve seen, and it’s really not that big of a deal in the long run.

Guest management with “Your Porter”

The most useful Airbnb management tool I have found is “Your Porter“, available as an App as well as on the web. (It costs ~$5 per active listing.) Here are the management tasks Your Porter can help with.

- Your Porter allows you to combine all your listings across multiple platforms into one calendar. This means I can see both HomeAway and Airbnb bookings for any of my listings in the same calendar.

- Your Porter allows you to automate messages. I use this for check in and check out messages. I schedule check in messages to go out at 11 am the day before check in, and 6pm the evening before checkout.

- In check in messages I include:

- the entry code for the keypad deadbolt

- parking instructions

- a simple description of the house to assist in finding the property

- wifi instructions

- a reiteration of the check in time

- For check out instructions I include:

- instructions to wash any dishes they’ve used and put trash in the trash cans

- reiteration of the checkout time

- notification of possible fees if they check out late without prior permission.

- Since guests often include questions in their messages when they first book, I use Airbnb’s pre-saved message feature for the “just-after-booking” message, customizing it to answer specific questions. You could also automate this message in Your Porter if you’d prefer.

To minimize questions, I’ve found the following information helpful in the “just-after-booking” message:- an introduction to who I am

- information about when they can expect their check in instructions

- a disclaimer that I cannot confirm early check ins or late checkouts until the day prior, (and requests of that kind should be submitted at that time)

- a few local recommendations.

- Your Porter also allows me to send daily text notifications to my cleaner reminding him/her of any cleaning happening that day, notifying them how many guest will be there, and indicating whether or not it’s a same day turnaround. In addition to this, Your Porter also allows you to share a calendar link with your cleaner.

- One alternative platform which has potential for cleaning management is TurnoverBnB. This platform sends either your cleaner, or a cleaner from their database notifications of new cleanings, and calendars/cleaning schedules, allowing them to “accept” cleaning gigs and then “check off” the cleanings as they’re completed, triggering automatic payouts. You can even set up a back-up cleaner who will receive notifications of any cleanings your lead cleaner rejects. To use automatic payments with an existing cleaner of your own, the platform charges a 3.9% fee. To let TurnoverBnb find a cleaner for you and pay that cleaner automatically, they charge a 5% fee.

- I pay my cleaners via PayPal once they’ve texted me that a cleaning is complete, but you could also have them “request payment” via PayPal or Venmo after each cleaning.

Finding/Managing a Cleaner:

I specify the following requirements in my Craigslist ad for a new cleaner:

- Must accept payment via PayPal or Venmo

- Must have their own transportation and cleaning supplies

- Must have regular availability between 11 and 3 (checkout and check in time)

- Willingness to cover other occasional guest related errands preferred

- Must email with information about past experience and availability.

In addition to handling bi-annual deep-cleanings and ordinary turnaround or “make-ready” cleanings, the cleaner you select is ideally also a person who can do various other guest-related errands and keep the house supplied with toilet paper, paper towels, hand soap, laundry detergent, etc. I have my cleaner send a photograph of the receipt for any supply purchases, then I reimburse for these expenses.

Deep cleanings only need done about twice a year- once before each peak season. For us, that’s Spring and Fall. I pay hourly for the deep cleaning, and a set price for the turnaround/”make-ready” cleanings. (This varies from $40-$100 depending on city, property size, number of floors, and existence or lack of carpet). I set a price by asking my interviewees their estimated rates for my specs, then I get an idea of the norms for that city.

Turnaround cleanings usually include the following:

- Emptying all trash cans.

- Replacing and laundering all linens. (If there is no laundry on site, I have my cleaner replace the sheets with back up sheets, then take hope the dirty laundry to wash and bring back next cleaning.)

- Setting out neatly arranged towels and washcloths for each guest.

- Light vacuuming

- Surface cleaning in bathroom, and cleaning the toilet

- Surface cleaning in kitchen if needed.

- Any other tidying as needed

For other guest needs, when possible, I simply use a service like InstaCart, Favor, or even Walmart Delivery to have items delivered to a guest, including a note to the delivery person to simply leave it at the door if no one is home (so that the guest does not need to wait around). Otherwise, I pay ~$30 for my cleaner to run an errand for the guest, plus reimbursement for associated purchases.

Conclusion

The biggest key to making money on Airbnb has been events or hot weekends where the supply is completely gone. You can make the majority of the profits in one month, and it can still be worth it.

This is also the reason that I think everyone should consider listing your place on Airbnb while you travel, which will be the subject of another (obviously shorter) post next week!

Also, signup and list your place via my link here, they’re giving $55 off your first stay!

Any questions?

Why a great and comprehensive post! Thanks for sharing. I’m a super host and still enjoy the read

Thanks! Glad to hear1

Drew,

Great write up and analysis as usual. yes another avenue to quit day job 🙂

BTW, your link to electronic deadbolt leads to desk lamp.

Thanks! Hah, yeah, although a lot real estate people like to keep the day job because it makes getting loans easier. :-p

(Fixed the link. Thanks!)

This is a fantastic post, thanks!

Thanks! Glad people actually get through it all the way down here to comment! 😉

Amazing amount of info 🙂

Wow, this is amazingly thorough. I actually was inspired by your rental arbitrage idea post a few yrs back and when I moved back to “civilization” after a couple years wandering this was my income as my other work picked up. It got to the point tho between a terrible landlord (who didn’t care I did airbnb, but also never did anything for the apartment) and just being too busy with other stuff (and not being able to find reliable people to work for me) it was too much, I actually just gave it up a few days ago. I didn’t make anywhere near the money you did, but did end up with like $10k profit on my TINY studio apartment over a year. I’m not sure I would do again, when it was a hassle, it was a giant hassle. My other work, even if not so passive, and probably less income too, is a lot more rewarding.

Anyway looking forward to visiting Austin soon!

I meant to mention that one of the big things for me was people wanted a response RIGHT. AWAY. very often. I don’t have my phone on me 24-7, during my work I can’t always check it, and I like to spend time frequently in wilderness areas that may literally have no signal for days. Something to keep in mind.

Dizzy – AirBnB will probably only Email/Text one person I’m guessing, but can you have anything from AirBnB forwarded to an ‘Assistant’ or spouse?

Drew- Incredible post as always. Whenever someone asks me how to make a succesful blog, I point them to your site. Great content, low / no ads, well organized =)

I love your blog and outside-the-box thinking but this is an excellent example of how Airbnb has lost the soul it used to have. As a consumer, I don’t even check there anymore. As a blog reader, I appreciate that you always try to present something no one else has!

Hi Drew,

I read the post yesterday and once again you show your thoroughness and willingness to share what you’ve learned. But living in a city where there was a huge fight about AirBnB and watching their appalling tactics, I have very mixed feelings. Moments later this deep dive in Wired popped into my feed, and I read it too.

https://www.wired.com/story/inside-airbnbs-guerrilla-war-against-local-governments/?CNDID=24864639&CNDID=24864639&bxid=MjM5Njc3NTQzMzkzS0&hasha=b803d628112fdd6a3b9a8a6ed52472bf&hashb=c8c01f6eb6fdea887ad20c91ed4d6fb5e73ecf77&mbid=nl_032019_daily_list1_p4&source=DAILY_NEWSLETTER&utm_brand=wired&utm_mailing=WIRED%20NL%20032019%20(1)&utm_medium=email&utm_source=nl

I admire your Yankee ingenuity and understand that some homeowners depend on AirBnB to enable them to stay in their homes. But I can’t ignore the other side: there’s a huge impact on neighborhoods, their sense of community, public schools, the tax base, and the ability for local folks to find affordable apartments to rent and homes to buy.

For example, the article explains that “a surge in short-term rentals has exacerbated New Orleans’ affordable housing crunch and turned entire residential blocks into de facto hotels. Jane’s Place Neighborhood Sustainability Initiative, a local housing group, says there were 4,319 whole-unit Airbnb listings in the city last year, more than double the 1,764 in 2015. The group found that 11 percent of operators, including many from outside Louisiana, control 42 percent of the city’s short-term rentals.”

Perhaps your strategy of buying into a market in a “lame” town is a way to minimize the negative impacts on a city and enable entrepreneurial folks to get into the AirBnB biz.

Drew, I think you know from conversations we’ve had in the past that I certainly am not against the profit motive. I’m posting now because I want to encourage people to consider the issue from all sides. Say hi to Carrie!

ES

PS – I debated posting this because I can imagine the replies that could come my way from people I don’t know and don’t want to debate. I won’t be responding to any of them. Have a terrific day!

This also was a concern for me, I got lucky in my apartment building but in general in certain neighborhoods I would’ve liked to live in, one can’t, and a HUGE part of it is from AirBnB’s (other part is investment properties from out of town/out of country people, and people moving from more expensive cities). I do feel better not to be contributing to that game even as much as I say F big biz/banks/etc and enjoy travel hacking n such.

Hey ES,

Sorry for the delay, I wanted to give a reply without being rushed.

I looked at this in the past and have continued to read about it when studies come out.

Overall, I’ve found one very consistent thing:

Those who are adamant that Airbnb is bad for a community and raising rent consistently use anecdotal evidence like “think about it”.

When I read articles that are against Airbnb I never see studies, facts, and statistics… I see “Obviously when one person rents a house for airbnb it can’t be used for long term rent”.

I see no articles with that point of view written like the one I’m about to share.

Yet, I’ve seen MANY studies that do statistical analysis to say the opposite.

Here was a big study done in Seattle:

https://internetassociation.org/publications/a-comprehensive-look-at-short-term-rentals/

It states, “The report finds no evidence that STRs negatively impact either the residential housing market.”

I can understand why it would seem obvious, a room is a room. But the main point I’d like to make is that in my personal hobby of reading about statistics I consistently find that statistical data can not easily be read and it’s not often intuitive.

In the book The Black Swan (which is all about statistics not showing the obvious) he talks about being at a statistician conference and polling people and on average people ranked the likelihood of an earthquake caused flood to be higher when ranking the probability of it hitting California than the US (even though California is in the US).

He talks about how it was easy to sell terrorism insurance at airports, than it would be travel/life insurance that cover ALL accidents.

With housing, the report I shared believes it’s not a zero-sum game.

It’s also interesting that people don’t oppose hotels or travel, when a hotel is prime apartment/condo real-estate. It’s literally the exact same concept at a larger scale.

Why would an Airbnb (rented fulltime for STR) be wrong and a hotel (a building converted solely for STR) not be?

They are virtually the same thing.

I’m shocked the study doesn’t indicate that Airbnb market has not hurt the hotel market either, but I imagine it would be more likely that a room on Airbnb would take away from hotel space instead of Long Term Rental. A building space can be used for anything and in Austin, they are building hotels all the time (which no one opposes that use of that building). Perhaps they aren’t competitors because Airbnb STRs are filling way less rooms per night than hotels, and perhaps they will become competitors. IDK.

But my point is, that if Airbnb’s were filling 1,000 rooms a night in a city, that there would be demand for one less hotel. That’s the entire theory of a free market.

That if there were the same demand for vacation nights and more supply, and same demand for long term rent, and less supply, the market would dictate the next high rise in Austin not be a Fairmont but a residential building.

In truth, that’s all guesswork. All I know for fact is that those who have greatly opposed STRs in Austin had no statistical data or studies, just anecdotal evidence. And that those in favor brought many studies like the one above.

The articles I find opposing are very different than the one I linked to, which is based on data, and they are more propaganda like, stating as a fact things that are not statistically proven. As Fox News well examples, you can prove anything with enough anecdotes, regardless of the data.

Which is all to say, for me personally, I don’t find it to be an ethical dilemma, and that’s not at all why I’m ending the rental arbitrage. But I can totally understand why it would seem that way to people and why the anecdotes would give confirmation to that view point.

@Drew Macomber, my family has a good amount of cash and I’m in the process of buying a rental in Nashville. I would love your advice on it and maybe if you’re interested we can partner up.

I understand the concepts and processes of renting and sub-renting (or sub”letting”). But which method are you suggesting here? Purchasing a home and renting it out to someone via Airbnb? Or signing a lease with an owner and then renting it out another level deeper?

Fantastic post! Last year, my city enacted very strict STR rules and zones which killed a very profitable STR that belonged to a close friend of mine. I see city ordinances and zoning rules as the biggest risk to the entire STR gig.

Great and comprehensive post, I am buying my first rental property soon so can relate with lot of this. I was speculating short term rental and this gives me lot of info and motivation to think seriously about it.

There is a lot of tax benefit if you can find a like minded CPA!

Did you pay for AirDNA? do you think it is work the money they ask?

My friend paid for the expensive nationwide one, and I didn’t find it all that interesting. However, if you are very serious about going anywhere in the country, perhaps it could be.

However, you can always search and see average monthly revenue.

I have paid for a specific city, and there are only two interesting things that I’m looking for:

1) Revenue. Which is one of the things shown for free…

2) Revenue per unit size. Does a 6 bedroom made 6x a 2 bedroom? If so, that’s a great deal. Especially if the cost is marginally more.

Okay maybe 3) The best zip code.

The problem with zipcodes or areas of town, is that the data is by nature smaller than the whole, and therefore less accurate.

However, if relevant could be relevant. Depends on market size I guess.

However, I don’t see the need to know about occupancy rates and monthly rates. If it averages profitable, that’s what matters.

Unless your problem solving strategies they can answer, I didn’t find it worth it.

Then again, I definitely paid for the cities I was in to start. One month was cheap and interesting enough I checked it regarding various things.

Great post! Spot on target. I also am a Super Host and been renting since they first started. I own several properties and also live off the rental income. It’s a great “retirement plan”. Definitely it’s a lot of work and the key is having a great property manager at each property.

In this Airbnb game you’re only as good as your property manager. I don’t own in the city that I live in and all my Airbnb properties are abroad. But it can be a really great investment. Plus if you buy in the right location, over the long haul it should appreciate nicely.

All the properties I bought 15 years ago have at least doubled in value. I don’t think about the capital appreciation too much as I’m focused on cash flow but it’s nice icing on the cake!

You didn’t even include Opportunity Zones!

Didn’t include lots of things… But not sure if I’d want an Airbnb with that strategy?

Nĭ Hăo Carrie and Drew,

You guys continue to amaze. We are in Fenghuang China now. Our flat in Portugal (200 meters from the ocean) is on Airbnb. We too have the …costing us to stay home dilemma (in the summer months). Location, location, location. We got lucky and found an excellent manager. She uses rules like yours. We quickly became Super Hosts, follow all the local regs and have good rapport with our neighbors without even being home…. Don’t discount the value of good (resourceful) managers (like yourselves) in the calculation.

We miss you!

Hugs from,

Dave & Michelle

Would love to visit that flat in Portugal when you’re there! Or China again. 😉

How are you handling emergencies at the properties? Especially the ones you don’t live near? I currently own a property in Pittsburgh that I’ve been AirBnBing for 5 months, but I’m disappointed in the results. I’m running a loss.

However, because I live in California, I’m paying a friend 20% of revenue to manage the property. I’m wondering if there’s another way…

Emergencies: We have a sheet with a list of people we can call. Plumbers, carpenters, handyman, cleaners, etc…

A plumber who you can call last minute is the majority of issues that can’t be solved by a cleaner.

We had a pipe break and had to refund the guest who couldn’t checkin, all in Mexico. That just happens, and I was on the phone with my plumber a lot. We had to talk to the guests, but the plumber did all the work.

A cleaner who runs errands like noticing when your low on paper towels or needs to buy sheets, or whatever, that’s invaluable. Our cleaners pay attention and when they notice something, they pick up stuff next time they are at the store.

We got really cheap people in the beginning and tested out people locally with small issues. But when I’m away, I pay extra to get it done quickly.

It’s pretty rare stuff breaks though.

The big thing is responding to messages quickly when we’re offline. Like when we hiked the Grand Canyon, Mexico, and the Rockies recently, we made our cleaner cohost and paid a flat $500 to respond to all the messages (on a bunch of places) or call relevant people. But nothing happened other than “can I check in early”. Otherwise most messages are automated.

I’m sure we’ll hand it off, but I don’t like the idea of paying a percentage of revenue.

I’d rather automate everything I can and get a cleaner that can handle everything else… as emergencies are really rare. All the cleaner has to do is call the plumber and the plumber knows I’m good for it.

Like if our expenses were $3,000 and revenue is $4,000, then 20% of revenue would be 80% of profit… which is huge. And it wouldn’t be uncommon to have higher expenses, and $200 extra here would be the entire profit.

Profitability.

If you’ve been doing it over winter, we rarely make money in winter… But especially lose money in winter if it’s the first months. No ratings and slow time is a bad combo.

The new big things are Airbnb Plus (if your place is nice enough) and next would be superhost. Also, pricing makes a big difference.

Would love to see/know feedback/cost/learnings for intl rentals by city. Any resources?

I know nothing about that, sorry.

I live in Austin and have a STR. How are you dealing with the city license as they don’t allow any more investment properties class licenses. The fees if you get caught are pretty steep.

Well, I don’t worry about it. We did get caught once and got a warning.

But it helps that our personal property is in an apartment where they can’t walk around and knock on doors like they do.

Although I have a friend that stays out of the city for that reason. But hasn’t been a real issue.

You mentioned that one of your rentals is in Mexico. I love the country, culture, and people, but sometimes it’s hard to get someone to do what they say they are going to do (there is a cultural bias against telling someone, “no”). In major tourist areas there are also “gringo tax” issues (not slamming Mexicans – the law of supply and demand applies in Mexico as well, and if the supply of English speaking trades people is low and the demand is high, well, that’s the way it is.)

Are there any special strategies that you can share about AirBnB in Mexico, or foreign properties more generally?

I stayed in an Airbnb in Mexico, but that’s as much as I know about Airbnb’s in Mexico.

Great post! Do you guys rotate the codes on the keypad or does it stay the same?

Um… We should.

The thing is that you can easily set an entry code to get in and out. Also you can easily set a master code to change the entry code. I did the entry but not a master. So I have a booklets for each master code, but I need to go change the master code.

Then it’s easy for a cleaner to do it. Otherwise, the only time we’ve changed them is after someone odd, and we go around and do it ourselves (which I don’t like cuz I’m lazy).

Honestly, people worry about it. But if someone is a thief, it’s not hard to copy a real key… No different.

Another fantastic post! Thanks for the great detail and the willingness to share with and teach others. You guys really are the best out there.

Thanks Ari! 🙂

Very comprenhesive post! Im curious have you considered doing any winter rentals in florida? A kind of

in between where snowbirds stay 3-4 months and pay way above market rate. Curious your thoughts?

I have not thought about that at all, not because it doesn’t sound like a good idea, I just have lots of other things.

But I wouldn’t go to a different state to do a 3 month rental unless it was killer profits, which it may be. But most likely is me flying out to set it up (which you could pay someone else) and that’s far too much work for me.

“it made me feel like living in my house was costing me money.” closest you came to recognizing the impact of you and your friends’ capitalist project

I mean, I responded to that above linking to one of many studies to show there is no negative impact on the community.

If anything there are lots of positive impacts of Airbnb in general.

Great post, Drew! So thorough and detailed.

My one issue is whether it is worth investing in a city where you *don’t* live. I live in a rural area in California, prices are high, and my wife and I haven’t jumped into a home of our own yet. She would also not be interested in leasing it out to strangers. However, I’ve mulled the idea of buying in another locale and either renting or using it as a STR. What are your thoughts on the viability of this? Your system makes it seem that it is possible. I would just hate for things to go wrong and have to go visit it frequently.

1) I did do this and it’s working out well.

2) Things did go wrong, and we had lots of repairs done when I was not there. Great repair people are critical. Also, if I had fixed it myself, Airbnb insurance wouldn’t have given me money for my time, but since I paid someone else I had the benefit of getting reimbursed and doing no work.

3) This is a great great reason to not buy a fixer-upper. My dad says, if it’s broken in places you (or the inspector) can see, it’s broken in places you can’t see.

I regret the house we bought because it was a “deal”. I’d rather have gotten a good deal (by nature of being in a cheap town) for a new place and not have to deal with month repairs.

That said, you could do an FHA (only 3.5% down) in your area and get a 3 or 4-plex and rent out the other sides.

But since I live in an expensive area it would be less profit on those margins than it would be in one of the cities I outlined in the spreadsheet. So I go elsewhere.

Also!

We rent our apartment in Austin and want to own elsewhere. It’s totally ideal because I never fix anything.

1) If an Airbnb guest breaks something, like I just mentioned, we get reimbursed for all repairs.

2) If a guest finds an issue that is just something on the property that needs repaired, we’re incentivized to pay and fix it immediately so the next guest can checkin.

So we never should be doing repairs anyways (the way I like it).

3) In our apartment in Austin, if something breaks on it’s own, management sends someone out to fix it right away.

Also, I’m certain our rent is cheaper than a mortgage in this area. Certain!

So we have the benefit of paying the least amount of money, getting the highest ROI on investment, and doing the least amount of work. I’m happy renting where we live!

Hey Drew,

Great Airbnb post, love the idea of posting of 1-4 bedroom options.

We’re trying to run the numbers on some additional cities and were wondering about where you got data points for a few columns:

Where are you getting growth percentages for your spreadsheet?

How about the monthly rent (assuming can’t STR)?

PS – RE: “Perhaps I could convince my buddy to help me write a more in-depth summary of his successful real estate hacks (it’s more impressive than any travel hacking story I’ve heard).” That would be great!

Well you blocked me on Twitter so i can’t have my told you so moment there, but for the record: I told you so

https://www.wsj.com/articles/a-bargain-with-the-devilbill-comes-due-for-overextended-airbnb-hosts-11588083336?mod=e2fb&fbclid=IwAR3I4ipO76I_FRQlRAxwb5wzTHCnMRJBA6UI7A_Rnk-vy0ZsSMqvLlxfC5E