How Does Having Multiple Credit Cards Affect My Credit Score? In short: It helps your credit score. However, there are many dumb things you can do along the way to hurt your credit score. I’m going to go over what, why and how.

The first thing I should say is that there is a lot unknown about the credit score system as the system is unpublished. The system is a science, only a few know it… It’s like Google. As someone obsessed with credit score and has been monitoring my credit score for years and have at least a dozen credit cards at any given point in time. And, not to sound arrogant but my credit score is dang good for someone who opened their first credit of any kind in July 08. I’m going to explain why I think signing up for multiple credit cards is the best thing you’ve ever done for your credit score.

The big things that make up your credit score are:

- Payment History – 35%. Are you on time every time? How many months and years have you been on time? You want to be on time and have many months behind you to prove it.

- Available Credit – 30%. What is your credit limit and how much are you utilizing? More credit limit is very good and high percentage of credit in use (debt) is bad.

- Age of Credit – 15%. How long is your oldest account? How long is your average account. The more time the better.

- Credit Inquiries – 10%. Also known as hard pulls or hard inquiries. Whenever you ask for credit (credit increase, a loan, a credit card) they keep track. We’ll come back to this.

- Types of Credit – 10%. There are four types and they give weight in this order.

- Mortgage.

- Installment loans. Like student loans or a car.

- Credit Cards.

- Retail Cards. Like a Belk or gas station card.

So let’s go over why credit card applications help and not hurt this process, proven with my experience.

History. How many months have you been on time? Well, many people think you have to make a payment to be on time but… it’s just not true. You’re on time anytime you’re not late.

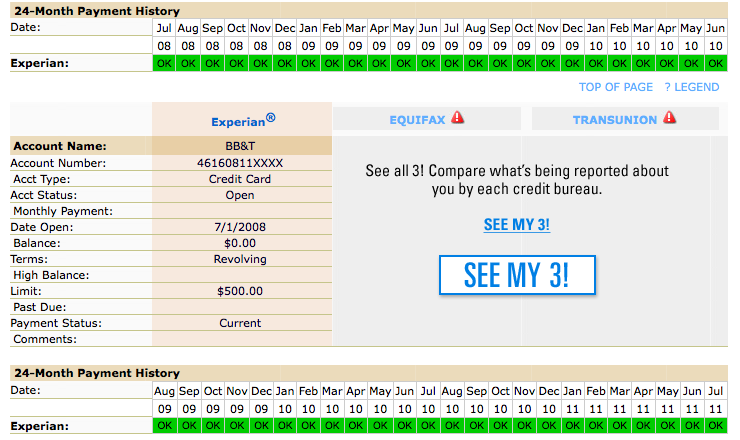

Let me tell you about my first card. In 08 I had never had any credit or my own checking account! So I went to the bank and opened one and they told me to get a credit card for overdraft protection, and so I did. Since then I have used that card zero times but here’s what it shows on my credit report.

Look, I have nearly 55 months of on time payment history from a card I have never used! (And I keep $8 in the bank account because I don’t want the card to close and haven’t used it in years). Now soon after, I started getting rewards cards – first the Chase freedom. Now I’m doubling the number of months of good history and history is the biggest chunk of the pie. History means being on time. The more good accounts you have the more good months you have.

To make this case perfectly clear, my friend Ben logged on the other day to a site to monitor his credit score, like CreditSesame.com, to view his score and there was a letter grade for each area of his account. I’ve been slowly turning him onto the credit card game and he recently applied for a few. Well, under account length he had an “A”, after all he’s had cards for a decade. For on time payments and account standing he also had an “A”. However, he noticed one of his grades was a “C”. Upset, probably at me for getting him to sign up for more cards, he was shocked when he read that he had too few accounts open, only 5!

Don’t get me wrong, more is not always better and I’ll talk about that. But first let’s talk about the second most import chunk of the pie.

Available credit. A bank will open a card with a credit limit based on how credit worthy they think you are. Over time, if you prove yourself, they raise your credit limit and thus, it looks good when you have a high credit limit. There’s something about it. When you have a high credit limit with one bank, other banks give you more credit as well.

As I said, I had one card with a random local bank and then got my first rewards card with Chase. And then I got another and Chase gave me a $5,000 credit limit. And then I got one with every bank that had a good airline card and they each gave me a $5,000 credit limit. The odd thing is, next time I applied for a Chase card (not too long later), they gave me a card with nearly $20,000 as the credit limit! And my score kept going up.

The other part is your credit usage. How much of your credit limit are you using? Hopefully you pay off your cards in full, but anything above 10% starts to hurt. 50% or more begins to look awful. Let me say, this is one of the only parts that can change instantly.

Age of credit is what you do have to be worried about. Although it does take up little percentage of the pie, in reality it has a lot more weight than credit inquiries. Listen,

- I have a lot of credit inquiries and not only do they not really effect your score (although maybe more so if you have less history).

- They go away after 2 years. Seriously, besides the reality that they’re indeed minuscule these dings (hard inquiries) are completely erased after 2 years.

- It’s spread across three bureaus. Everything else is shared but hard pulls are unique to each bureau.

- How else do you get credit without hard pulls?

- It’s no big deal. I know I’ve tested it.

What is a big deal first and formost is being on time, then having a low credit usage. But the only thing that applying for rewards cards can do negative is shorten your average length of accounts. If you apply for a bunch of cards that have huge annual fees for the first year and you cancel them your second… eventually you’ll stunt your growth. So make sure you open cards with no annual fees or some you don’t mind keeping.

- The Chase Freedom Card and one of the Hilton cards has no annual fee.

- The Chase Sapphire Preferred and the Ink Bold are downgradable.

- I keep the American Airlines card for the passive benefits (like 10% of your points back) and the Hyatt card and the Priority Club card for the free night they give every year.

When you think about your credit score you need to think about growing your score. You do that by having good accounts. Sometimes two cards will build twice as much good history. Getting more cards is not going to solve all your problems, in fact, it could be a bad thing if you have spending problems or trouble keeping track of your accounts. Bottom line is this: your credit is not determined by how much money you have. My sister-in-law bought her house in cash and couldn’t get a single credit card because she didn’t need or use loans or credit. Your credit is instead made up of how sure they are that you will pay money back. They know this by how much credit you have been trusted with.

In summary, having more accounts and handling them well is a good thing. You don’t need 20 but all I’m saying is that Ben got a “C” for only having 5 open accounts. C! Get over the myths you hear and don’t listen to the 19 year old clerk at your bank. Do some research and monitor your score yourself!

Nice summary, Drew!

I could not refrain from commenting. Well written!

I had heard that business cards (like ink plus) don’t show up on your personal credit history for the age of account or the amount of credit extended to you. Is that incorrect?

I’d personally enjoy to retire where air conditioning is not needed, in addition to a dog park with benches is nearby.

Where is your video on Credit Card applications? A recent video I saw(you sitting in the park) was great put I can’t seem to find it.

Great article. The only thing that DOES matter is store credit cards. They do count against you if you have more of them. Once you’ve opened it, don’t close it. The damage has already been done. But opening a ton of those can stunt your credit score growth.