The travel rewards currencies

There are three types of earning currencies we’ll talk about:

Airline miles

Airline miles Hotel points

Hotel points Bank (or credit card) points

Bank (or credit card) points

The difference between airline miles and hotel points is pretty simple, but what about the difference between these and credit card points? We’ll explain the difference in a bit…

Let’s talk about airline miles first

These are frequent flyer miles for a specific airline as a rewards or loyalty program.

For example, if you have the American Airlines credit card, the United Airlines credit card, British Airways credit card, etc… then when you spend on that card you earn that airline’s miles. The sign up bonus and the miles from spending go right into your frequent flyer account for that airline. And if you don’t have a frequent flyer account don’t worry, they’ll create one for you when you sign up for the credit card.

What about hotel points?

It’s the exact same concept as airline miles. These points are specific to each hotel chain and when you have a hotel branded credit card, the hotel points go straight into your account.

Now let’s talk about bank points

The banks and credit card companies also have their own rewards programs.

For example, Chase has Chase Ultimate Rewards and American Express has Membership Rewards. Therefore they also have credit cards to earn those points. So not only does Chase partner with airlines and hotels to create credit cards for those rewards programs, they also have credit cards to earn Chase points- their own points.

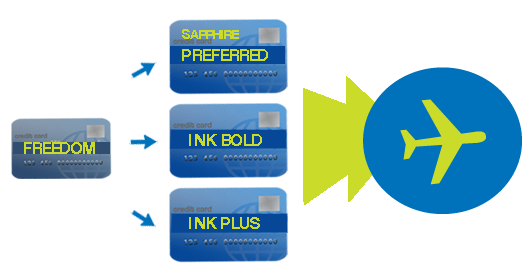

Chase has the Chase Sapphire Preferred, Chase Ink Bold, Chase Ink Plus, etc… Each of these cards earn Chase points.

American Express similarly has the Platinum Card and Gold Card, both which earn Amex Membership Rewards Points.

What does this have to do with travel?

With these cards you are earning bank points instead of miles but you can often transfer them over to airline miles. Be aware though, if you don’t transfer them over to miles, the bank rewards program may try to get you to use their own “travel” shopping portal to redeem your points for about 1 cent a point.

Please, whatever you do, don’t use your bank points to buy travel on the bank’s own website! Please, instead transfer your points to miles first. Instead of getting a fixed value of 1 cent a point that the bank reimburses, you can get much better value out of miles. I’ve gotten as much value as 25 cents per mile (although that’s the higher end).

For instance in this post you can read about the Pacific Hopper that gave us a value of at least 25 cents per mile.

So turn those points into miles first, then book your travel outside of the bank’s travel-booking portal.

One odd thing to note is that Chase’s lower cards like the Chase Freedom and the Chase Sapphire regular/non-preferred card earn Ultimate Rewards points but they don’t transfer to airlines. However, you can transfer points from the Freedom card to a card that does transfer to airlines, which we’ll talk more about below.

How to transfer your points:

There are three main currencies to transfer from:

1.) Chase Ultimate Rewards Points

2.) American Express Membership Rewards Points

3.) Starwood Preferred Guest Starpoints

Chase and American Express are banks, while Starwood is unique because it is a hotel chain/rewards program that transfers to frequent flyer miles at a very generous rate. When you transfer 20,000 Starwood Preferred Guest Starpoints to a mileage program, Starwood will give you a bonus 5,000 miles.

But how do these transfers happen?

Chase Ultimate Rewards

Chase gives you the option to redeem points for travel through their own booking portal, as mentioned above, but the real value is in transferring to miles. However, you can only do this with certain Chase cards. Namely the Chase Sapphire Preferred card, Ink Bold card, or Ink Plus card. Each of these cards offers the ability to transfer Chase Ultimate rewards points to a mileage program.

If you have the Chase Freedom card, a more introductory no annual fee card, you can still earn Ultimate Rewards points, but you would need to transfer these points to one of the aforementioned cards in order to then transfer them into miles.

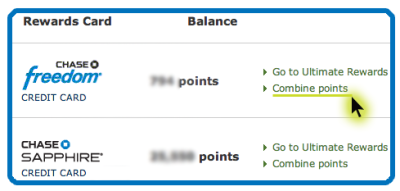

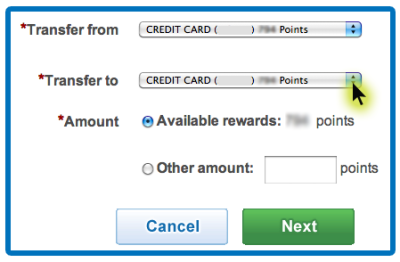

How to combine points:

1.) Log onto your Chase account online.

2.) At the right hand side of the screen, click “Go to Ultimate Rewards”.

3.) This will bring you to a screen detailing your various cards. Click “Combine Points”.

4.) Use the selection tools to identify that you would like to transfer points from your Chase Freedom to your Chase Sapphire Preferred, Ink Bold, or Ink Plus.

How to transfer:

1.) Log onto your Chase account online.

2.) At the right hand side of the screen, click “Go to Ultimate Rewards”.

3.) This will bring you to a screen detailing your various cards. Click “Go to Ultimate Rewards” again.

4.) Hover over the “Points Transfer” tab and select where you would like to transfer. You will be able to do this in 1,000 point increments.

Transfers are same day if not instant.

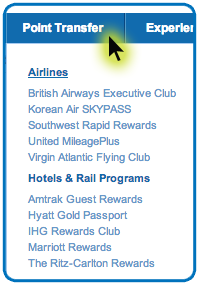

Who do they transfer to?

Chase UR points transfer 1:1 to:

Airlines

British Airways, Korean Air, Southwest, United, and Virgin Atlantic

Hotels

Hyatt, Marriott, IHG, and Ritz Carlton

Rail

Amtrak

Who should I transfer to?

Miles are usually a lot more valuable than hotel points as flights are often more expensive than hotel rooms.

![]() United miles are the only miles-transfer option from Ultimate Rewards that don’t pass on fuel surcharges, (something we’ll talk more about later). For this reason as well as their good economy award chart and very generous stopover rules, United is a favorite UR transfer for many.

United miles are the only miles-transfer option from Ultimate Rewards that don’t pass on fuel surcharges, (something we’ll talk more about later). For this reason as well as their good economy award chart and very generous stopover rules, United is a favorite UR transfer for many.

British Airways is a popular miles program for flights within North America and South America, simply because there are no fuel surcharges to pass on in these flights. Plus, flights like Miami to Cancun are only 4,500 British Airways miles (aka Avios).

British Airways can be quite stingy though too- redeeming your miles on British Airways itself (or another partner with similar fuel surcharges) outside of the Americas can be well over $600, for an award ticket. What can be a love/hate depending on where you will be flying from is their distance based award chart. They price not only by distance flown, but by segment.

![]() Hyatt is generally the best hotel transfer from Chase. To showcase Hyatt’s reasonable award chart, you can compare it to the other transfer options. A top category hotel redemption with Hyatt is 30,000 points; the top hotel redemption with IHG is 50,000 points and the top hotel redemption with Marriott is 70,000 (for Ritz Carlton hotels).

Hyatt is generally the best hotel transfer from Chase. To showcase Hyatt’s reasonable award chart, you can compare it to the other transfer options. A top category hotel redemption with Hyatt is 30,000 points; the top hotel redemption with IHG is 50,000 points and the top hotel redemption with Marriott is 70,000 (for Ritz Carlton hotels).

While Hyatt has many of the nicest hotels and for reasonable prices, IHG does have its perks too. The IHG PointBreaks sale lists tons of hotels every two months for 5,000 points, not to mention, their points are much easier, and cheaper to come by.

American Express Membership Rewards Points

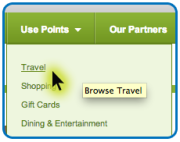

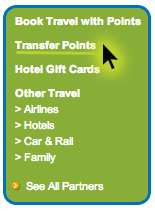

How to transfer

1.) Sign in to membershiprewards.com.

2.) Select “Travel” under the “Use Points” tab.

3.) On the left hand side of the page you will see “Transfer Points.” Click on this.

4.) Follow the prompts to choose your transfer option.

Transfers are the same day if not instant.

| Airlines | Hotels |

|---|---|

| British Airways – 1:1 | Hilton – 1:1.5 |

| ANA – 1:1 | SPG – 3.3:1 |

| Air Canada – 1:1 | Choice – 1:1 |

| Alitalia – 1:1 | Best Western – 1:1 |

| Singapore – 1:1 | |

| Asia Miles – 1:1 | |

| Hawaiian – 1:1 | |

| Delta – 1:1 | |

| AeroMexico – 1:1 | |

| AirFrance/KLM – 1:1 | |

| Virgin – 2:1 | |

| JetBlue – 2.5:2 |

Who should I transfer to?

Again, miles are more valuable than hotel points. The only problem is that none of the miles transfer options are completely without fuel surcharges. So one would need to do some research on what route they need and then if they could find a partner without fuel surcharges.

The airline transfers list above was put in order of personal likelihood for transfer. British Airways is at the top for it’s cheap short flights and lack of fuel surcharges on domestic trips, or flights within the Americas.

Starwood Preferred Guest Starpoints

Starwood is a hotel brand and thus you can earn via the credit card or via regular hotel points earnings from paid stays and promotions.

How to transfer

1.) Sign in to your American Express account online and select your Starwood card.

2.) Click “Redeem Starpoints” at the right hand side of your screen, or follow this link.

3.) Scroll down to the “Transfer to miles” option, (skipping the “Redeem for flights” option); select the “Transfer to miles” option.

4.) Follow the prompts from there.

These transfers can take 1 to 2 weeks.

Who do they transfer to?

The full list can be found here but you can see a few recommended options below.

Especially good transfer options

American Airlines – 1:1

US Airways – 1:1

ANA – 1:1

Air Canada – 1:1

United isn’t featured above because the transfer ratio is 2:1 instead of 1:1. Therefore most people opt to transfer to AA miles. Not only does AA have a great award chart but there are also fewer other ways to transfer to AA as compared to what you’ll find with BA Avios.

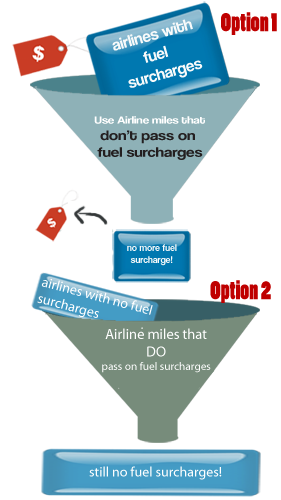

Thinking about fuel surcharges

There are a few programs that I can always depend on to not have fuel surcharges. Some airlines have good reward prices but to redeem those miles, you pay $600+ in fees!

My favorite no-fuel-surcharge-fee airlines are: United Airlines, American Airlines and US Airways (now merging with American Airlines).

How to get those miles:

United – United card, United Business card, Chase Sapphire Preferred, Ink Bold, Ink Plus

American – American AAdvantage visa, American AAdvantage American Express, American AAdvantage MasterCard, Starwood (SPG)

US Airways – US Airways card, Starwood (SPG)

Other airline miles I enjoy: Air Canada, British Airways, ANA

However, those latter airlines do have fuel surcharges. But there are ways to avoid paying fuel surcharges even when using those miles.

Let me explain three things.

1) When you have miles with an airline, you can redeem them for any airline within the alliance.

2) The price in miles will be determined by the program whose miles you are using, not by which airline you’re redeeming with.

3) Not all airlines have fuel surcharges built into their pricing model in the first place. In other words, you can redeem your miles for flights on some airlines within the alliance that don’t have fuel surcharges to pay for.

Star Alliance

Airlines with fuel surcharges:

Air Canada, Air China, ANA, Asiana Airlines, Austrian Airlines, Brussels Airlines, EgyptAir, Ethiopian Airlines, LOT Polish Airlines, Lufthansa, Scandinavian Airlines, Singapore Airlines, South African Airways, Swiss, TAP, Thai Airways, Turkish Airlines, United Airlines (on international flights, except within North and South America and

the Caribbean).

Miles that don’t pass on fuel surcharges:

United, Avianca and TACA, and US Airways

Airlines with no fuel surcharges to begin with:

Air New Zealand, Avianca, TACA, TAM, US Airways and United (within the Americas).

One World Alliance

Airlines with fuel surcharges:

American Airlines (on international flights, except within North and South America and the Caribbean), British Airways, Cathay Pacific, Finnair, Japan Airlines, Malaysia Airlines, Qantas, Royal Jordanian

Miles that don’t pass on fuel surcharges:

American Airlines, LAN

Airlines with no fuel surcharges to begin with:

Air Berlin, American Airlines (within the Americas), Iberia, LAN

SkyTeam Alliance

Airlines with fuel surcharges:

Aeroflot, Air Europa, Air France, Alitalia, China Airlines, China, Eastern Airlines, China Southern Airlines, Czech Airlines, Delta, Kenya Airways, KLM, Korean Air, Vietnam Airlines

Miles that don’t pass on fuel surcharges:

… …

Airlines with no fuel surcharges to begin with:

AeroMexico, Saudia

Overview of “The Complete Guide to Miles Earning with Credit Cards”…

>The three currencies of credit card earnings are frequent flyer miles, hotel points and bank points.

>Miles will take you further than either of the other currencies. Given the choice between redeeming bank points with the bank’s travel portal or transferring to miles, always transfer to miles first.

>The three types of points that are most commonly collected and transferred into miles are Chase Ultimate Rewards, American Express Membership Rewards, and Starwood Preferred Guest Starpoints.

>When you transfer your points, think about transferring to a mileage program that doesn’t pass on fuel surcharges.

>When using a mileage program that does carry on fuel surcharges, redeem your flights on an airline with no fuel surcharges to begin with.

This complete guide was written and designed by Drew and Carrie of Travelisfree.com

This complete guide was written and designed by Drew and Carrie of Travelisfree.com