Take your game to the next level – that’s a large focus for this blog. But this post is a heavy post with tons of concepts and reading material to help more advanced miles and points collectors learn even more besides just hearing about deals. There are many amazing deals out there you need to know about (like Flying Blue) and earning options out there that are available for you to choose the best option. I give an example where choosing a lesser known transfer can save 92% of your miles, and that is a huge difference. If you’re interested in taking your game to that next level, this is the post for you.

Take your game to the next level – that’s a large focus for this blog. But this post is a heavy post with tons of concepts and reading material to help more advanced miles and points collectors learn even more besides just hearing about deals. There are many amazing deals out there you need to know about (like Flying Blue) and earning options out there that are available for you to choose the best option. I give an example where choosing a lesser known transfer can save 92% of your miles, and that is a huge difference. If you’re interested in taking your game to that next level, this is the post for you.

On the redeeming side

For me the helpful difference between earning a ton of one thing and a moderate amount of a variety of things is the ability to play into each program’s strengths and weaknesses. You can initially go out and earn points that play to a certain strength, but you have to know what the strengths and weaknesses are.

It’s not good enough for instance to know that ANA might be the cheapest way to go from Europe to Egypt, you have to also know that ANA passes on fuel surcharges, and European airlines have a lot of fuel surcharges to pass on. A simple ticket I priced out with ANA to Egypt (that I abandoned) would have run me $800 in fees… for an award flight! The strength of a possible ticket to hop all around the region, was greatly outweighed by the weakness.

It takes time to know the full range of possibilities, so don’t get overwhelmed. The best way to learn is to plan a trip, or to even plan out what miles are best for your trip. I at least absorb a lot of info this way.

Want to go to Greece? Start looking at the cheapest airline miles. Then consider if those airline miles would pass on fuel surcharges, and if there are any airlines that wouldn’t have fuel surcharges on the route.

Strengths to look for in terms of miles, are usually good prices, good routings and stopovers.

If you’re looking to see the best posts on each rewards program check out the posts in my 10 best posts of 2014. (Or see Best Use of 11 Airline Programs).

Knowing the Good Deals

I’ve been doing a series on the Cheapest Miles to a destination, and while that’s a great place to start, the chart itself may leave out great deals. For example, Flying Blue has sales where you can get award flights with discounts as much as 50%. These aren’t consistent at all, but they are a strength none the less.

Hopefully that Cheapest Miles series will provide a lot of info in the article itself on where these deals are, but the other way to start is to get to know a rewards program. I’ve written about many “lesser known” programs to get to know.

But there are also great deals among popular programs. And for that you really need to get to know each program and how they function.

The biggest example: distance based programs

British Airways is a distance based program that only charges 4,500 Avios for really short flights like Miami to Jamaica. While American Airlines is an incredible mileage program in other ways, the same route would cost 17,500 AA miles. On the other hand, many long distance flights are so much cheaper with AA miles.

Unfortunately, there’s no easy trick for knowing everything about the programs. It’s hard to list every great route by each program and every discount. Still I try to dedicate a post to the deals and discounts of each program:

Best Uses of 11 Airline Award Programs – really this is the best overview I’ve done on “sweet spots” for each program.

Stopovers

Stopovers are largely under-used and overlooked among miles collectors. But what’s crazy is when I hear of people who could book an extra stop for free with a stopover, but they end up using more miles booking a separate oneway later. Believe me, for airlines that allow stopovers it doesn’t raise the miles price of the ticket at all. It is a second (or more) destination(s) for completely free.

If you want to up your stopover game here are some posts that may be helpful:

List of Airline Stopover Rules – which has almost every airline’s stopover rules listed.

Complete Guide to United Routing Rules – this hopefully takes you from A to Z with United.

For extreme examples of great stopover tickets see:

- The 3 United Miles “Hopper” Flights

- ANA Stopover Secrets

- United Stopover Secrets

- British Airways Stopovers

Creating the cheapest route

Knowing stopover rules and knowing all the deals really adds up to one thing: using the least amount of miles possible. When you have a ton of miles and a ton of hoped for flights, it’s a matter of using the right miles at the right time. Furthermore, it’s not using the miles that would be best for a later trip.

For example if I had Flying Blue miles, they might be the best for a trip to Tahiti later. But if my first trip is to Europe and I look and see that I have both United and Flying Blue miles, I want to use the more expensive United miles for Europe now, knowing that I won’t be able to use them for Tahiti later. Does that make sense? Basically, it’s about spending miles in a way that uses the least total miles, and not just the least amount for the current trip.

Same/same with hotel points. Let’s say I have IHG free nights and Hyatt free nights. In London it’s tempting to use two free nights at the InterContinental London since it’s so nice, but let’s say you are going to two cities- London and Rome. But the fact of the matter is, there is no Hyatt in Rome and there is an IC. It makes way more sense (from a frugal stand point) to use your free Hyatt nights in London and free IHG nights in Rome.

This is a very simple problem solving example as there are only two cities involved, two points currencies, and only one trip. But things get tougher when you’re looking ahead at tons of trips and choosing between tons of points options.

Some good reads:

Best advanced redemption posts:

- The New United’s Stopover and Routing Rules Secrets… with Pictures

- What I didn’t say about United open-jaws

- The New Best Use of AA Miles (why you don’t need the Explorer Award Chart) & Hacking AA’s routing rules

- 4 Variations of the Pacific Hopper

Get familiar with “Hidden Gems”:

- Best Use of Flying Blue Miles

- A Guide to ANA Miles

- How to Redeem Big with Asia Miles

- Best Use of Singapore Airlines KrisFlyer Miles

- Best Use of Malaysia Airlines Enrich Miles

- Choice Hotel Rewards

- Best Use of Amtrak Guest Rewards

- Best Use of Citi ThankYou Points

- 5 Things You Should Know about Southwest

- Frequent Flyer Miles for Round-The-World Tickets

- Hidden Gem Airline Redemptions

- Transfer to AirBerlin – Two Roundtrips to Europe for 60k

On the Earning Side

I’ve said this before but MS is entirely about trying things when you don’t know for sure what you’re doing at first. By the time you have red arrows to explain it to you… it’s done. You need to go out now and try things yourself.

And trying things is all about risk management. There is nothing wrong with buying a $500 gift card not knowing if your preferred technique for liquidating will work. Buying $10,000 would not be smart at this point. But in absolute worst case scenario you could send money via PayPal and lose 3% (which I’ve certainly never done) or use it for actual spending or who knows what. As long as you have a worse case scenario strategy, try it.

If it works, try two next time.

I’ve opened a scary number of credit union accounts, gift card accounts, and enrolled in all kinds of weird websites in order to test things. And that’s also about risk management- start small if you’re worried.

Knowing the value of your travels

I have said this time and time again, the value of miles and points is not a number picked completely arbitrarily by your favorite blogger. The value of my hotel points are dependent upon my use.

Furthermore, look at your real costs.

As you likely know, we keep track of and post every spend we make. This has opened my eyes, as I’ve been able to do detailed posts on the breakdown of every dollar we spend.

I found two years ago in Europe while chasing IHG promotions that I spent $2,000 on IHG hotels. But I also found that when I also considered the number of redemptions I got from the points, my average was around $30 a night!

However, this only matters if it’s on track. If before the promotion I was averaging $100 a night then $30 a night is a huge improvement.

But let’s say I earn plenty of points from credit card promotions and what not and I honestly don’t pay for hotels. Most people I know don’t travel as much as we do (we live out of hotels) and they can actually cover all the hotels with points and don’t need paid stays. So if the promotion got you to pay $2,000, then you’re not winning $30 a night… you got suckered into paying $2,000.

This is one of the many reasons I find it annoying when people believe that the value of a Hyatt point is 2 cents, or something like that. Because then people think that they are saving money when they get Hyatt points for 1.5 cents. But it’s not remotely true.

What you need to do is know your actual costs. Knowing my average redemption and average costs, I can honestly know whether or not buying at 1.5 cents per point would save me money. And in this case… no way.

Not saying that you need to calculate and breakdown all of your travel costs. Rather let me put it like this, “you can go broke saving money.”

Applying for credit cards

In terms of earning miles from credit cards I want to give a couple of tips. First, understand not just how credit score works, but how the credit card companies are making decisions. (Read: Does having multiple credit cards hurt my credit score?)

In terms of earning miles from credit cards I want to give a couple of tips. First, understand not just how credit score works, but how the credit card companies are making decisions. (Read: Does having multiple credit cards hurt my credit score?)

What I really mean is knowing which bank uses which agency and why it matters. Too many hard pulls can be bad for getting new cards, but hard pulls are per credit bureau. But having too many accounts shows up for all bureaus once they’re open. Too many new ones means you have to wait awhile.

Another thing is that having a balance on your cards that uses too much of your credit can be bad when applying for cards.

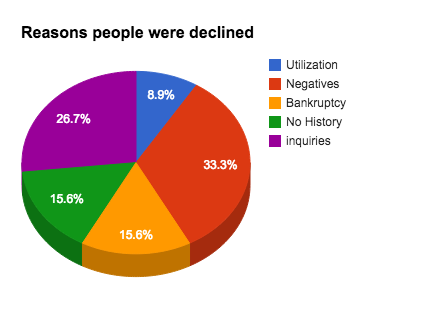

Some of this may be well known to people in this hobby, but I decided to go through statistics of denials and reasonings, as well as bureau info, and make a post full of charts explaining the data. If you’re interested in a higher understanding this is a great post.

Read: What Credit Score Do You Need For A Rewards Card (A Data Driven Answer).

Earning from more than one card

One thing I’ve talked a lot about with the Amtrak transfer to Choice, is that there is more than one way to get what you need. It’s not true with everything, but it’s almost always true that you don’t need just one kind of hotel point or airline mile for a certain city or route. And of the options available, one of them might have multiple earnings.

Again, using Choice points is a great example because 10,000 points a night is by far the cheapest points hotel in Venice. You could transfer 1:1 from Chase to Marriott and get a hotel in Venice for 40,000 Marriott points, which is way more expensive. But what’s incredible is that you can transfer 1:1 from Chase to Amtrak, and then 1:3 from Amtrak to Choice.

You’re essentially using 3,333 Chase points a night now. Imagine that you are now saving 92% if you would have considered Marriott. Just by earning with the right place, you can get a value increase you can’t get elsewhere.

Yet, it’s part knowing the redemptions again, but it largely includes earning. Just by MSing with the right card you would have the same affect. Using Chase instead of MSing with Hilton, for example.

Another great example is this post: 15 Credit that earn Hilton HHonors Points.

Already Hilton has a lot of options, but really there are 15 different options (or possibly more). This could start with a redemption goal, but it’s also being savvy on the earning side. Technically the Virgin Atlantic 75k is the biggest Hilton sign up bonus.

A lot of this is conceptual. Airlines transfer to hotel points and hotel points transfer to airlines. Knowing the good transfer rates and waiting for bonuses is not always beneficial in that way…

In any “Complete Guide” I have an earnings section, but one beginner post I find really useful myself is the “What Credit Cards Transfer To What Miles“. Sometimes I honestly can’t remember everyone that transfers to JAL, ANA, Flying Blue, or whoever. That would be a basic level of earning and transfers.

For knowing which hotel transfers to what airline and vice versa, you have to go to the program’s website. I have to say though, it’s rare that it’s a great transfer rate, but sometimes promotions and opportunities come along.

Conclusion

I know this is a long post with a ton of readings, but I hope there is at least one link in here that can help the most advanced person get some ideas and learn something new. But don’t tell me you didn’t until you read all the posts that were linked to above. 😀

Great tip on the transfer from Amtrak to Choice. I didn’t know that was an option & have been reading points blogs across the web for over 2 years now!