People commonly ask what kind of credit score they need to get a rewards card, but until now I didn’t have a data driven answer. Now I can tell you the minimum scores that get approved, denied, and the minimum credit line they’ll need to open with. I’ve even analyzed reasons for denials and which banks use which agencies.

People commonly ask what kind of credit score they need to get a rewards card, but until now I didn’t have a data driven answer. Now I can tell you the minimum scores that get approved, denied, and the minimum credit line they’ll need to open with. I’ve even analyzed reasons for denials and which banks use which agencies.

There is a website called credit boards where people can report their scores, credit details and for which credit card they were approved or declined. The idea is that when you receive your approval/denial letter it will state your credit score, and if it’s a denial it will have a reason for the denial. I put hundreds of these into a spreadsheet and quantified data for each credit card to show people what kind of credit each bank is looking for.

I’ll run through this with the Chase Freedom and go over what the data actually means. Then show the credit bureau overview data, and most importantly, the “reason for denial” data.

And btw, you can get a free proxy credit score at creditkarma.com, or you can go straight to the bureau and do a 14 day trial and make a dozen memos to cancel on day 13.

Chase Freedom

Of the 93 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 19

- Experian = 52

- TransUnion = 22

| Approval Score | Decline Score | Credit Limit | ||

| Min | 625 | 648 | $500 | |

| Max | 802 | 727 | $26,000 | |

| Average | 712.5340909 | 674.8888889 | $5,293 |

People with scores as low as 625 have been able to open cards with as little credit as $500.

What does the data mean?

The two most important details are the lowest approved credit score, and lowest credit limit.

With Chase in particular, they have certain credit limits that they have to open you with. If you’ve never managed $500 in credit before, you probably can’t get the Freedom card. And as you’ll see, if you’ve never had $5,000 in credit limit, you probably can’t get the Chase Sapphire preferred.

Now they maybe decided after a year of having a lower credit limit that if you applied now, they indeed would give you a $5,000 credit line. So a better way of saying that is that they want to know if you’re worthy of a $5,000 credit line. The only way to prove that is a good history of on time payments.

The other thing that could be an indicator of how much credit you’ll need is the lowest approved credit limit. It shows a general idea of what kind of credit you need to have to get this type of card.

Chase Sapphire Preferred

Of the 85 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 21

- Experian = 43

- TransUnion = 21

| Approval Score | Decline Score | Credit Limit | |

| Min | 629 | 710 | $5,000 |

| Max | 838 | 750 | $30,000 |

| Average | 744.3095238 | 730 | $12,233 |

People with credit scores as low 629 have gotten approved for credit limits as low as $5,000.

Why is the minimum decline score higher than the minimum approval? There are a lot more data points for approvals than there are declines. In this case there are only 3 declines and they are pretty high scores (710, 730, and 750). Declines were due to; negative marks, high utilization, too many inquiries and a “low income to rent ratio” (a new one for me).

Chase United Explorer

Of the 66 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 19

- Experian = 30

- TransUnion = 17

| Approval Score | Decline Score | Credit Limit | |

| Min | 644 | 669 | $2,000 |

| Max | 850 | 700 | $32,000 |

| Average | 724.7619048 | 682.75 | $10,489 |

People with credit scores as low as 644 have opened cards with a mere $2,000 credit limit.

Why is the minimum decline score lower than the approval score? Because there are tons of data points for approvals and few for declines. Here there were only 4 decline data points for this card.

Chase Southwest

Of the 71 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 24

- Experian = 33

- TransUnion = 14

| Approval Score | Decline Score | Credit Limit | ||

| Min | 608 | 615 | $1,000 | |

| Max | 746 | 806 | $25,000 | |

| Average | 672.8888889 | 708.7868852 | $7,950 |

People with a credit score as low as 608 have been able to open cards with as little as $1,000 credit limit. However, note that there are two different types of Southwest cards and the Premier may be more difficult to get.

Chase Ink Bold

Of the 10 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 5

- Experian = 3

- TransUnion = 2

| Approval Score | Decline Score | Credit Limit | ||

| Min | 700 | 651 | $5,000 | |

| Max | 792 | 651 | $35,000 | |

| Average | 742.625 | 651 | $11,111 |

People with scores as low as 651 have been approved for cards with limits as low as $5,000. (This card had very few data points and only one decline).

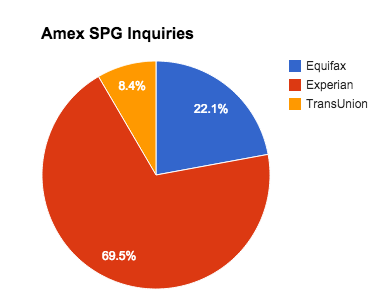

American Express Starwood

Of the 95 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 21

- Experian = 66

- TransUnion = 8

| Approval Score | Decline Score | Credit Limit | |

| Min | 623 | 578 | $1,000 |

| Max | 813 | 730 | $30,000 |

| Average | 716.2317073 | 660.0909091 | $7,253 |

People with credit scores as low as 623 have had accounts opened with limits as little as $1,000.

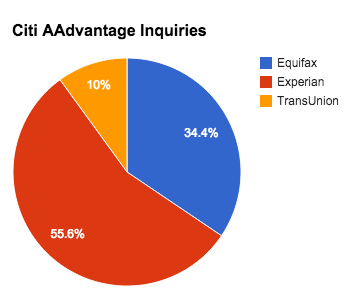

Citi American Airlines

Of the 90 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 31

- Experian = 50

- TransUnion = 9

| Approval Score | Decline Score | Credit Limit | |

| Min | 602 | 639 | $770* |

| Max | 800 | 705 | $26,500 |

| Average | 714.0506329 | 675.6 | $7,856 |

People with credit scores as little as 602 have opened up cards with limits as little as $770. (*The next lowest credit limit reported was $2,200 which seems more commonly reported and more realistic.)

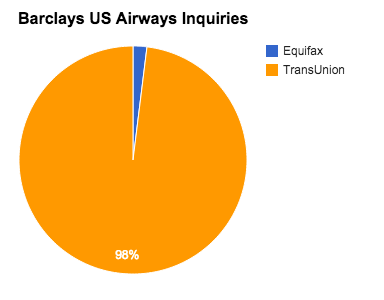

Barclay US Airways

Of the 51 reports I looked at, how many of the applications were with each credit bureau?

- Equifax = 1

- TransUnion = 50

| Approval Score | Decline Score | Credit Limit | ||

| Min | 654 | 646 | $1,000 | |

| Max | 793 | 787 | $15,000 | |

| Average | 724.1702 | 734.5 | $6,865 |

People with credit scores as little as 654 have had cards opened with limits as little as $1,000.

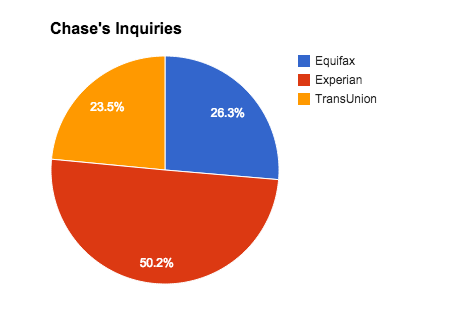

The Different Credit Bureaus

Combining all information from all the Chase cards I looked at (315 reports), Chase used the following credit bureaus, the following amount of times:

- Equifax = 83

- Experian = 158

- TransUnion = 74

Out of 95 reports how many of the applications for the Starwood card were with each credit bureau?

- Equifax = 21

- Experian = 66

- TransUnion = 8

Out of 90 reports how many of the applications for the American Airlines card were with each credit bureau?

- Equifax = 31

- Experian = 50

- TransUnion = 9

Out of 51 reports how many of the applications for the US Airways card were with each credit bureau?

- Equifax = 1

- TransUnion = 50

The things I’ve learned is that it’s a bit of a myth that one bank pulls one credit bureau. It’s not true. In fact, many notes said, “I applied because I thought they pulled xxxx agency”. They might be inclined to pull one agency, and for you they may pull the same one. But it is not a hard rule.

Also the average score thing is deceiving as each bureau’s ratings are different. So if you’re looking at your score and comparing it to the scores above, try checking the score with the bureau that was pulled most. This will give you the most accurate idea.

Example of breaking down average, max and min scores by Bureau

I took the records for the Chase Freedom and broke down the results by Bureau used. Here are the results:

TransUnion

| Approval Score | Decline Score | Credit Limit | |

| Min | 625 | n/a | $500 |

| Max | 802 | n/a | $25,000 |

| Average | 724 | n/a | $7,096 |

Experian

| Approval Score | Decline Score | Credit Limit | |

| Min | 635 | 648 | $500 |

| Max | 800 | 696 | $25,000 |

| Average | 710.2083333 | 668 | $4,469 |

Equifax

| Approval Score | Decline Score | Credit Limit | |

| Min | 648 | 671 | $500 |

| Max | 786 | 727 | $26,000 |

| Average | 707.8333333 | 699 | $5,182 |

Results

The credit lines are almost identical. It doesn’t matter which bureau is used, you still need $500 as a minimum and the average is still close to $5,000.

However, the minimum approval was lowest with TransUnion, and highest with Equifax. Still the results are pretty close. Yet, people commonly report 100 point swings between bureaus. The same person could have a 600 TransUnion and 700 Experian. This is due to the different factors taken into account and the fact that some data or existence of negative marks may be unique to that agency, for whatever reason.

Of course the data pool is lower when splitting the results like this, but it gives you an idea. It’s best to know all three of your scores if you’re really trying to accurately compare.

It’s all about your credit report not your score

Understand that your credit score is based on your credit report. It doesn’t really matter what your score is, it matters what your report is, and especially your recent reports.

Think about it. For the same card some people get approved with little scores and some people get declined with high scores. Your score is simply an indicator of how the banks are going to view your credit history. A low score means that you’ve screwed up too much. Screwing up too much means that they likely won’t give you lots of credit. And you need lots of credit on very rewarding cards.

In other words, there are reasons for denials that are larger than “your score is too low”. You need to know what is it that’s bringing down your score and what do they not like? You need to know what are your issues?

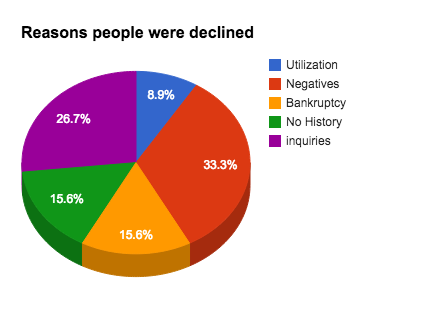

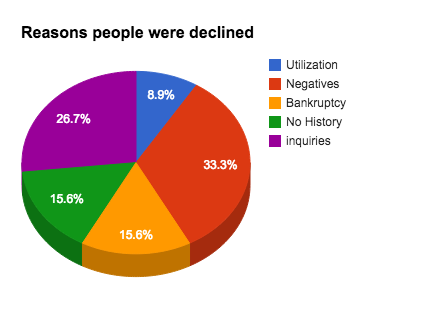

Actual Reasons for Denials

In the denial letters researched, the following reasons were cited:

In the denial letters researched, the following reasons were cited:

- 4 = Credit utilization is too high (when you have $20,000 in credit limit but $10,000 in debt, that’s a 50% credit utilization, which is way too high).

- 15 = Negative marks on history, like late payments.

- 7 = Bankruptcy.

- 7 = Too little history. Not enough accounts open, not enough time with open accounts, etc..

- 12 = Too many credit inquiries (applying for credit)

What does the data mean: While this does reflect on why people are getting denied, the input of data is also directly tied to people, not just the bank. In other words, the bank might deny someone with a recent bankruptcy 100% of the time for a great rewards card, but it could be that a smaller number of people have bankruptcy in their history and are trying to apply for these cards. It’s a reflection of the banks and the users.

Never the less, all the denials fit into these basic categories – High utilization, negative marks, bankruptcy, too short of a credit history, and too many inquiries. It’s interesting that negative marks is the highest source of declines. It does emphasize the importance of being on time.

And while it does reflect on why people get denied, it also reflects on why people aren’t getting denied. I didn’t see: too many cards/accounts, too high of a credit limit (a myth), average account length is too short, too low of an income, etc…

Now a bank can decline you for reasons outside of credit. For example, a bank can deny you for too little income, although that wasn’t a reason given in the data I saw. There was one example where a guy said that his income to rent ratio was too low. A bank could deny for that reason, or really any other financial or credit related reason. However, above are data driven reasons for denials.

Interesting fact about credit inquiries (aka, hard pulls)…

First, most of the denials for too many inquires were multiple applications within 2 months.

Second, at least half of the denials for too many credit inquiries were listed with another reason. Meaning, of the denials that listed the reasons, almost all of the reasons stood alone except for inquiries. When it was bankruptcy, that was reason enough. Too little history is reason enough. But when they cited too many inquiries it came with another reason.

Usually, inquiries by itself is not reason enough for a denial. And of the ones that were cited as the only reason, it was specific to a very recent time frame. Generally, if you have multiple inquiries on the bureau pulled in the last month or so, you will be denied.

And one last detail about “hard pulls” or inquiries… they are completely erased from your credit report after 24 months. Thus, it’s better to apply and build good credit than to worry about the inquiries themselves. The positive aspects of good accounts, having more credit limits and building relationships with banks far outweighs the tiny impact of hard pulls.

Conclusion

What you need is to prove your credit worthiness by having good open accounts. People weren’t getting declined for too many cards, but too few cards and too little history. So the second thing on the priority list is to build credit.

The first thing on the priority list is to completely avoid delinquencies of any kind! It can be healed, but it can be a long road. Many of the bankruptcy denials I saw were very old. Most other negative marks were in the last couple years. So avoid any negatives, and if you’ve had negatives, do what you can to recover. Or… if it’s been a problem, avoid credit at all cost. It’s not free money, it could mean that you’re paying way more for your stuff than you should be via interest.

I hope that sheds light on what kind of credit score you need to get a rewards card. The answer is, depends on the credit card or bank, and depends on why your credit score is what it is.

That’s it for me. Hope you enjoyed the research as much as I did.

Drew

This is excellent analysis and some great pointers. Brilliant. Do you have any pointers for the Amex Platinum card?

Thanks. Unfortunately there wasn’t enough info for me to include, but I got approved a while ago, back when my score was like 700.

I find it interesting that the Southwest credit card had the lowest average credit score. With the 50K bonus that is frequently offered, I think this card offers an excellent starting point for those interested in budget domestic travel.

I definitely keep the Southwest cards coming. But yea, that’s a good point, I was surprised they’d open the regular one with only $1,000.

My EXP is full of inquiries. probably need to stop apply for a year…

Stop???? Why?

So you suggest applying for some just to see what happens? Or is it wise to hold off until one is more sure of the result?

Absolutley fantastic! I have nothing negative except my first few student loan payments were missed. NOTE: I’m caught up now and even had my monthly rate lowered. I’ve heard that I can send a letter to fedloan and even to the credit bereaus to clear that up. I’m tryin to pin the details down on that to get them accepted.

I just read an article that said that solved issues like that will be able to be taken away from your credit report. Which… would be awesome. Good luck with that. Although, those little dings aren’t as bad with time.

Hi Drew,

I’ve done at least 3 app-o-ramas following your blog now.

Now it’s time for me to do another one, really would love your feedback.

Do you mind sharing all the credit cards you have and how long you have had them for?

Thank you

Boy… that would be a long list. I mean the thing is, I’ve had pretty much every single card that exist EXCEPT the delta cards and citi thankyou cards and a few cashback cards. But other wise, I mean every airline and hotel… except fairmont. So really honestly, like everything. So I’m not sure how much it would help.?

I’d find it more interesting to hear how much unsecured credit you have available from all of these different cards as a broke 20-something full-time traveler making $xx,xxx ;-p.

End-game strategy of converting it all into cash-equivalents and then retiring to SE Asia?

The creditboards data is really interesting, there are a few things worth mentioning though.

1). The credit bureau a card issuer pulls is location dependent. For example you had Chase at 50% for Experian, but if you live in California it’s actually more like 80% chance they’ll pull Experian. On the other hand if you live in Michigan it’s a 90% chance that they’ll pull TransUnion.

This is because the three nationwide credit bureaus used to be a bunch of much smaller companies focusing on specific states and they when then bought up by what is now known as the big three.

2. Visa signature cards are always going to have a minimum credit limit of $5,000. This is a visa requirement. It used to be the same for Mastercard world elites, but it’s no longer the case.

3. The credit scores listed are all different models and version numbers, not all approved applications come with a credit score and in those cases CB members just use FAKO scores by one of the free credit monitoring services.

What credit scoring system are you using in the above data? The thing to be careful of, and which is not always differentiated on creditboards.com, is that FICO, Vantage, and others use different numerical scales. So without knowing for sure which scale is used, or at least that it’s consistent across the data, it can provide different results and interpretations. Sort of like Fahrenheit vs. Celsius – 0 degrees in one is different from 0 degrees on the other.

I believe I explained in the post in detail how it was TransUnion, Experian and Equifax.

I had a 629 in equifax can I get a walmart credit card or they pull transunion